A good credit score can be a valuable asset throughout your life, opening doors to loans, credit options, insurance benefits, utility services, and job opportunities. If you’re wondering what constitutes a good credit score and how to improve it if needed, read on for a quick guide to good credit scores.

Understanding Credit Scoring Models

Credit scores are calculated using various scoring models, with FICO and VantageScore being the major players. However, both of these have multiple variations, leading to slight differences in the scores they provide. Your credit score may vary slightly depending on the scoring model or credit bureau used.

What Defines a Good Credit Score?

A good credit score falls within the “good” range specific to the scoring model you’re using. For FICO, a score between 670 and 739 is considered good, while scores from 580 to 669 are considered fair, and anything below that is deemed very poor. A FICO score of 740 or higher is considered very good or exceptional.

VantageScore’s definition of a good credit score is between 661 and 780, with anything above that considered excellent, and scores below that range categorized as fair, poor, or very poor depending on how low they are.

The Impact of Your Credit Score

Having a good or better credit score demonstrates that you responsibly manage your debts and obligations, making you an appealing candidate to lenders and creditors. This makes it more likely for you to be approved for credit and offered competitive interest rates.

While you can still obtain credit with a less-than-perfect score, specific loans cater to people with bad credit. However, these types of loans often come with less favorable terms and higher interest rates.

Credit reports may not only be considered by lenders but also by auto insurance companies, utility providers, landlords, and even potential employers (with your consent) to assess your financial reliability and decision-making.

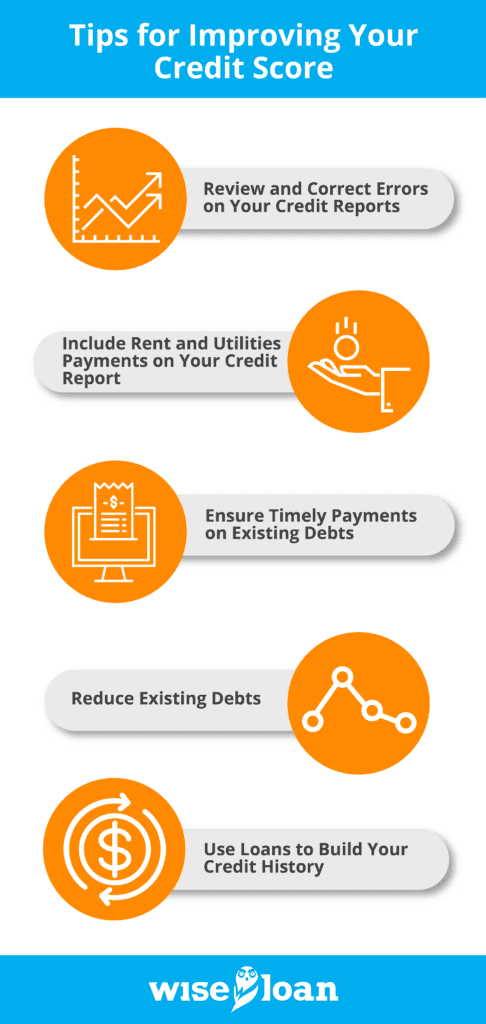

Tips for Improving Your Credit Score

Improving your credit score is not an overnight process, so beware of anyone promising instant fixes through products or services. However, there are steps you can take to positively impact your credit over time, some of which might show results in a few weeks or months.

- Review and Correct Errors on Your Credit Reports

To begin, obtain your credit reports from all three major bureaus. You can access them for free once a year at AnnualCreditReport.com, or consider using free and paid services that provide year-round access. Carefully examine your reports for any inaccuracies, such as:

– A payment marked as late, even though it was paid on time.

– A collection account that does not belong to you.

– Incorrect outstanding amounts listed on credit lines.

If you identify any errors, take action by disputing them with the credit bureau. Draft a letter detailing the error, provide supporting documentation, and explain why the information is inaccurate. Federal law grants you the right to a fair and accurate credit report, ensuring that the bureau investigates your dispute. If the entity reporting the information cannot verify its accuracy, the bureau must rectify or remove the disputed information. Eliminating such inaccuracies can significantly improve your credit score.

- Include Rent and Utility Payments on Your Credit Report

Generally, rent and utility accounts are not automatically reported to credit bureaus by landlords and utility companies. However, you can utilize services like LevelCredit to have these payments reflected on your credit report. This becomes particularly useful if you lack a substantial credit history.

- Ensure Timely Payments on Existing Debts

Consistently making timely payments on your existing personal debts is crucial for boosting your credit score, regardless of the scoring model used. Payment punctuality carries significant weight in credit assessments, so strive to meet your obligations on time.

- Reduce Existing Debts

Reducing the amount of debt you carry, especially on revolving accounts like credit cards or lines of credit, can have a positive impact on your credit score. Credit utilization, which refers to the percentage of your credit line that you have used, is a factor considered in credit scoring models. Lowering your credit utilization by paying down debts can lead to an improved overall credit score.

- Use Loans to Build Your Credit History

Lenders like Wise Loan offer products designed to help people build their credit. Qualifying for a loan, such as an installment loan, does not necessarily require an excellent credit score. By making timely payments on this loan, Wise Loan reports your positive behavior to credit bureaus, thereby assisting you in establishing a better credit history and positively affecting your credit score.

To explore your eligibility for such a loan, consider applying with Wise Loan today.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.