Top Causes of Personal Debt in 2025

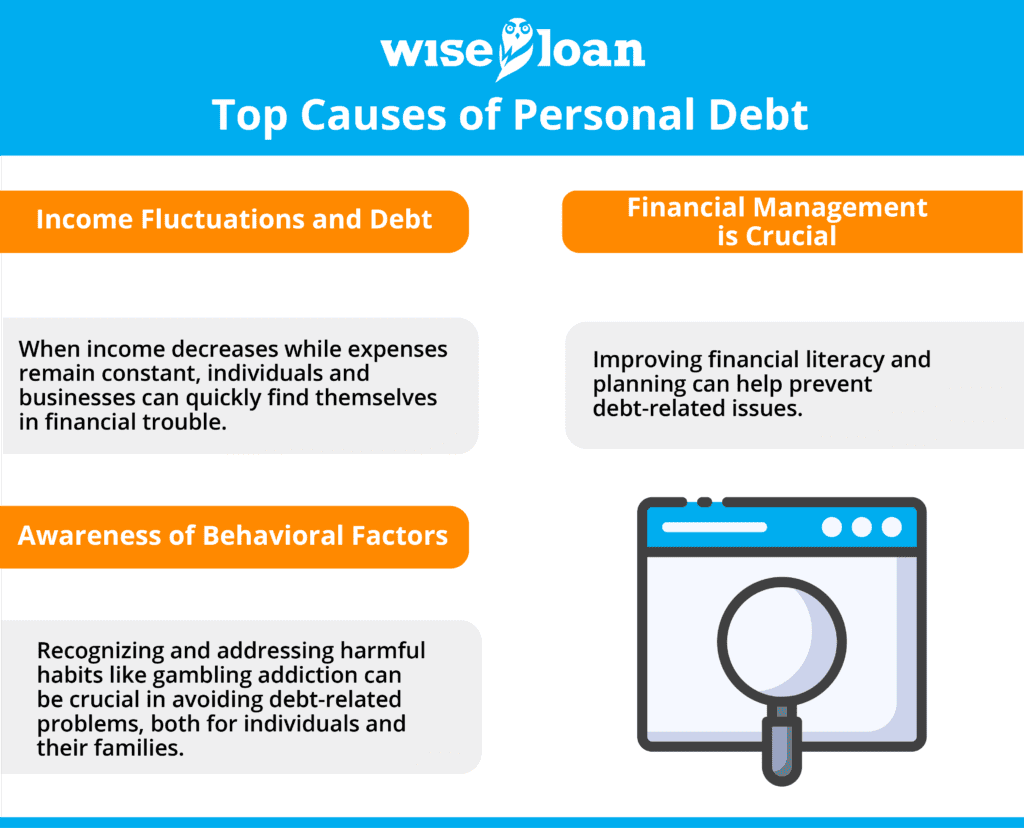

Why are so many smart, hardworking people buried in debt? It’s not always poor choices—it’s often a perfect storm of rising costs, unexpected emergencies, and no one ever teaching you how to manage money in the first place. If you’re here, you’re probably asking: Why am I in debt—and how do I fix it?

Debt isn’t always the result of carelessness. In today’s economy, even responsible people can find themselves in the red. From rent hikes to medical bills to job instability, financial setbacks can hit hard and fast. And while some debt stems from unavoidable life events, a lack of financial knowledge or planning can quietly push you deeper into it—month after month.

At Wise Loan, we believe that understanding the why behind personal debt is one of the most powerful ways to prevent it—and start turning things around. This guide breaks down the real reasons people fall into debt in 2025, and what you can do (right now) to protect your future.

1. Loss of Income

A sudden drop in income—whether it’s from a layoff, reduced hours, or a medical leave—can quickly throw your finances off track. Unfortunately, bills don’t shrink just because your paycheck does.

Fixed costs like rent, car payments, and groceries remain steady, and without savings or alternative income, many are forced to turn to credit cards or loans to make ends meet.

In fact, according to a recent Bankrate survey, only 44% of Americans could cover a $1,000 emergency with their savings. That leaves more than half of the country vulnerable to falling into debt during a financial emergency.

💡 Need a safety net during an income gap? Wise Loan offers short-term personal loans that can help you manage urgent expenses without relying on high-interest credit cards.

2. Medical Expenses

Medical debt continues to be a leading cause of financial hardship in the U.S. Even with insurance, out-of-pocket costs for prescriptions, specialist visits, emergency care, and surgeries can add up fast.

A 2024 KFF Health Care Debt Survey found that nearly 41% of American adults carry some form of medical debt—many of whom delayed care because of the cost.

When medical needs arise unexpectedly, many people are forced to charge medical bills to credit cards or skip essential care altogether. Either option can lead to a spiral of debt.

3. Poor Budgeting or Money Management

Not everyone is taught how to manage money—and it shows. Without a clear budget, it’s easy to lose track of where your money is going each month. Subscription creep, impulse shopping, and inconsistent tracking can chip away at your bank balance until there’s nothing left for savings or emergencies.

If you’re not already budgeting, start simple. Use the 50/30/20 method or a budgeting app to see where your money goes—and make adjustments before it becomes a problem. For more help, check out our Beginner’s Guide to Budgeting.

4. Credit Card Misuse

Credit cards can be helpful tools—when used responsibly. But they also carry some of the highest interest rates in consumer finance. As of early 2025, the average APR on credit cards has hit 22.8%, meaning unpaid balances can grow rapidly even with minimum payments.

Relying on credit for everyday expenses can quickly snowball into thousands of dollars in revolving debt. It’s best to use credit cards for planned purchases you can pay off immediately—or to build credit with small, manageable transactions.

If you’re already overwhelmed by credit card debt, Wise Loan may be able to help you consolidate with a fixed-rate installment loan.

5. Student Loans

Student debt continues to be a long-term burden for millions of Americans. While recent federal changes have offered some forgiveness options, the average student loan borrower still owes over $37,000, and many pay for decades.

High monthly payments and accruing interest make it difficult to build savings or qualify for major purchases like a home or vehicle. If you’re struggling, look into federal repayment plans or refinancing options—and avoid defaulting, which can damage your credit for years.

How to Avoid Common Traps

Debt isn’t always avoidable—but many of its causes are manageable with the right strategies. Here are a few ways to stay in control:

-

Build an emergency fund, even if it starts at $10/month

-

Create and stick to a budget (use apps if needed)

-

Limit credit card use to what you can repay monthly

-

Plan for medical costs with HSA/FSA contributions if available

-

Get support early if you’re dealing with gambling or addiction

When Debt Happens, You’re Not Alone

Debt doesn’t mean you’ve failed—it means life got real. A medical emergency. A busted transmission. A paycheck that didn’t stretch as far as it used to. These things happen. What matters most is what you do next.

At Wise Loan, we’ve helped thousands of people who were in the exact same spot—stressed, overwhelmed, and unsure how to move forward. We get it. You’re not looking for a lecture. You’re looking for real options that actually help—not confusing fine print or interest rates that bury you deeper. That’s where we come in.

Our personal loans are built for people like you: people who are trying, who are working hard, and who just need a little financial breathing room. Whether it’s covering an emergency expense, paying off high-interest credit cards, or consolidating debt into one manageable payment, we make it fast, simple, and straightforward. No surprise fees. No penalties for paying early. Just the help you need, when you need it.

And unlike traditional lenders, we don’t judge you by your past. We focus on helping you build your future. Our loans are reported to all three major credit bureaus, so every on-time payment helps you rebuild your credit and reclaim your financial momentum.

You deserve to feel confident about your money again. You deserve a second chance. Let’s take the next step—together.

👉 Apply now or call us at 800-516-7840. Wise Loan is ready when you are.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: