A strong credit score is essential to prove to creditors that you are likely to fulfill your debt payments as agreed upon. But what exactly is the target number that qualifies as a good credit score, and how can you achieve it? Discover all the details in the following concise guide to good credit scores.

Understanding Credit Score Ranges

Credit scores are calculated using credit scoring models that consider the information from your credit report at one of the three major credit bureaus. Employing intricate mathematical algorithms, these models generate a three-digit number that acts as a beacon, informing lenders and others about your creditworthiness.

The credit score scale ranges from 300 to 850, with higher scores being more favorable. The rule is simple: the higher your score, the better your credit standing. However, there are additional complexities to consider.

Two Credit Scoring Models

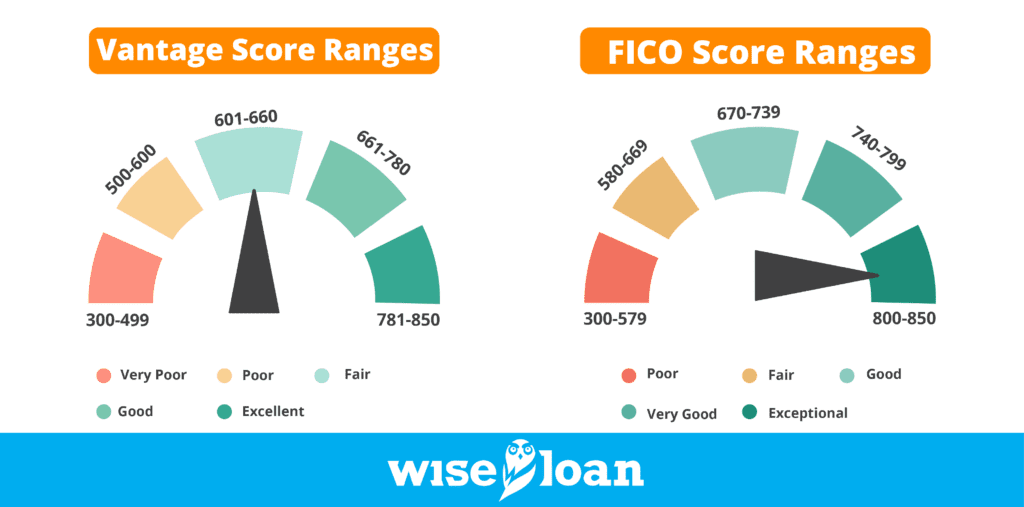

Two primary credit scoring models are in use: VantageScore and FICO®. The credit score required for “good” credit slightly differs for each model.

– 300-499: Very poor

– 500-600: Poor

– 601-660: Fair

– 661-780: Good

– 781-850: Excellent

– 300-579: Poor

– 580-669: Fair

– 670-739: Good

– 740-799: Very good

– 800-850: Exceptional

Factors Impacting a Credit Score

Now that you understand the credit score ranges for good or better credit, you may be wondering what influences your score. According to Experian, one of the three major credit bureaus, five key factors significantly contribute to your credit score, regardless of the scoring model.

These factors collectively paint a picture of your risk as a borrower, and credit scoring models use this information to calculate your overall score.

- Payment History

Your payment history reflects how well you have managed debt payments in the past. This is one of the most critical factors in determining your credit score. Late payments or defaults on debts imply a higher likelihood of repeating such behavior in the future.

Most lenders, including banks, loan companies, and credit card issuers, report your monthly payments to at least one of the major credit bureaus. Any late payment, regardless of the duration, can negatively impact your credit score. More extended periods of delinquency, such as 90-day late payments, have a more significant impact. Defaulting on a loan or debt obligation can cause a substantial drop in your score.

- The Amounts You Owe

The more debt you owe to others, the riskier you appear as a borrower. If you are already fully leveraged in repaying existing loans and credit cards, it raises questions about your ability to manage new debt obligations.

While your overall debt amount plays a role, your credit utilization is a more critical factor. Credit utilization refers to the percentage of your revolving credit limit that you have utilized. It’s advisable to keep your credit utilization at 30% or less of your credit limits.

- Length of Credit History

The age of your credit history is significant since it indicates your experience in handling finances and repaying debts responsibly.

Both the total duration of your credit history and the average age of your open accounts matter. If you have recently acquired your first credit card or loan, your credit history might not be sufficient for scoring. On the other hand, maintaining credit accounts consistently over the years provides a longer history for calculating your credit score.

In summary, a good credit score is one that demonstrates to creditors your reliability in making debt payments on time. The credit score scale ranges from 300 to 850, with higher scores being more favorable. There are two main credit scoring models: VantageScore and FICO®. These models have slightly different credit score ranges for “good” credit. Your credit score is influenced by several factors, including payment history, the amounts you owe, and the length of your credit history. To maintain a good credit score, it’s essential to manage your debts responsibly and make timely payments.

- Credit Types Diversity in Your Reports

A well-rounded mix of credit types contributes to your credit score. Lenders want to see that you can effectively manage various types of debt, so it’s beneficial to have both revolving (like credit cards) and installment accounts (like loans) on your credit history. By diversifying the types of credit you use, you can enhance your credit score.

- New Credit and Credit Inquiries

While it might seem that applying for new credit accounts can quickly boost your credit score, the reality is more nuanced. Although having greater access to credit is advantageous in the long term, applying for new accounts can temporarily lower your score.

Hard inquiries, which occur when a lender assesses your creditworthiness for a loan or credit product, can slightly decrease your score. Multiple hard inquiries within a short period could be enough to push you out of the range of a good credit score. Additionally, if a hard inquiry leads to a credit application denial, the negative impact is twofold. Not only does your score suffer from the inquiry, but you also gain no new credit benefit.

Tips for Achieving a Good Credit Score

Considering the factors mentioned above, here are some effective ways to build or improve your credit, leading to a better credit score:

- Timely Payments: Make sure to consistently make all your payments on time. Payment history holds significant weight in determining your credit score, and missing payments or defaulting on debts can hinder your progress toward a good credit score.

- Smart Credit Card Management: Avoid maxing out your credit card balances whenever possible. Utilizing more than 30% of your credit limit on your cards can negatively affect your credit score.

- Regularly Check Credit Reports: Review your credit reports regularly and be on the lookout for any errors. Even a minor mistake could lead to an undeservedly lower credit score. Obtain your free credit score from annualcreditreport.com and dispute any incorrect information.

- Seek Credit-Building Products: Consider using credit-building products like secured credit cards. Additionally, there are loans specifically designed for individuals with less-than-ideal credit. Ensure that you make timely payments and choose companies that report your progress to all three credit bureaus, maximizing the positive impact of your efforts.

At Wise Loan, we report to two of the three credit bureaus and offer loan options that don’t require excellent credit for approval. Start your application today to begin your credit improvement journey.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.