Build Your Credit Score With Store Cards

Are you interested in establishing a positive credit history and improving your credit score? If so, store credit cards could be an option worth considering. Let’s delve into what store credit cards are, how they can aid you in building credit, and explore some credit card options available for your consideration.

Understanding Store Credit Cards:

Store credit cards come in two main types. The first type is a store-specific card, which allows you to make purchases on credit solely at that particular store. An example of this would be department store credit cards, granting you a line of credit exclusively for shopping at that specific store.

The second type of store credit card is store-branded Visa, MasterCard, or other major credit cards. With these cards, you can generally use them anywhere credit cards are accepted. However, when shopping at the store affiliated with the card, you may earn additional rewards such as cashback or points for future purchases.

How Store Credit Cards Can Help Build Your Credit:

Store credit cards can contribute to building a positive credit history and affecting four key factors that influence your credit score:

- Payment history: Timely and consistent payment of your store credit card bill demonstrates responsible credit management and positively impacts your credit score.

- Credit utilization: Maintaining a new store credit card with a low balance can reduce your credit utilization ratio, which is beneficial for your credit score.

- Credit age: While opening a new store credit card initially lowers your average credit age, keeping the account open and in good standing over time can increase your credit age positively.

- Credit mix: Having different types of credit accounts, such as installment loans and credit cards, can enhance your credit mix, making a store credit card a useful addition.

It’s essential to use your store credit card responsibly by budgeting and promptly paying off your purchases to avoid accumulating debt.

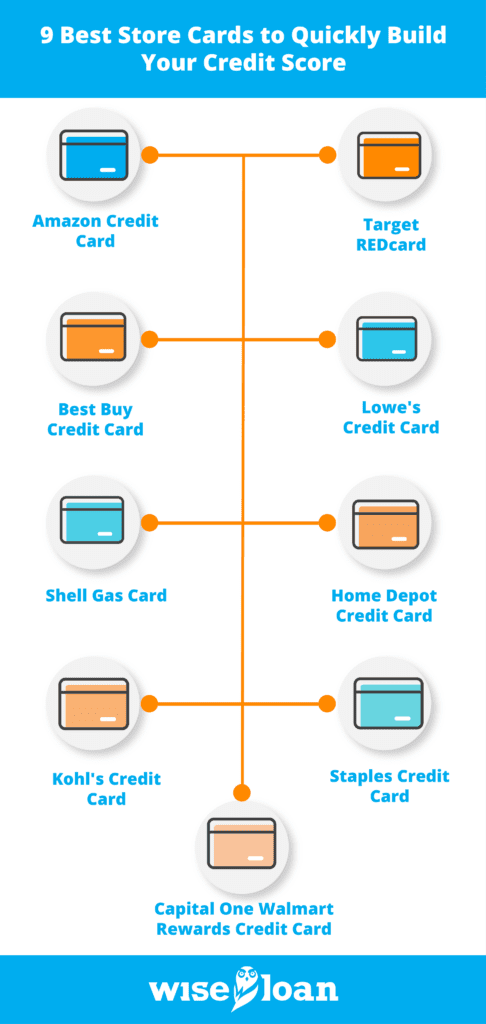

Nine Store Credit Cards to Consider:

Here are nine store credit cards that encompass both store-specific cards and store-branded Visa or MasterCard options:

- Amazon Credit Card: The Amazon Rewards Visa Signature Card allows you to earn between 1 and 5% cashback on purchases, particularly rewarding when shopping at Amazon properties.

- Target REDcard: Target offers both a store-specific REDcard and a Target REDcard Mastercard, both offering a 5% discount when shopping at Target or Target.com.

- Best Buy Credit Card: Best Buy offers a store-specific credit card with special financing options and a branded Visa card for more versatile use.

- Lowe’s Credit Card: Lowe’s provides personal and business credit cards, offering perks like 5% off qualified products or special financing for a certain period.

- Shell Gas Card: For frequent drivers, the Shell fuel rewards credit card offers rebates of up to 10% on eligible purchases.

- Home Depot Credit Card: Home Depot provides both a store-specific credit card and a Home Depot-branded Mastercard with benefits like interest-free financing.

- Kohl’s Credit Card: The Kohl’s charge card offers in-store credit and exclusive monthly savings deals for cardholders.

- Staples Credit Card: Staples offers business and personal credit cards with 5% back in rewards on purchases.

- Capital One Walmart Rewards Credit Card: The Walmart-branded Mastercard rewards you with cashback, with the highest rate of 5% for Walmart.com purchases.

Exploring Other Credit Options: Personal Loans

If store credit cards are not suitable for your needs or you’re looking to finance a purchase not available in these stores, you might consider a personal loan. Wise Loan offers instant funding and doesn’t require excellent credit for approval. Feel free to apply for a Wise Loan installment loan today.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: