Improving your credit score is a gradual process that requires consistent efforts. Establishing a strong track record of timely debt repayment and responsible credit management will have a positive impact on your score, potentially elevating it to a good or excellent level. While there’s no magic formula to achieve an instant credit score boost, there are actionable steps you can take to accelerate positive developments.

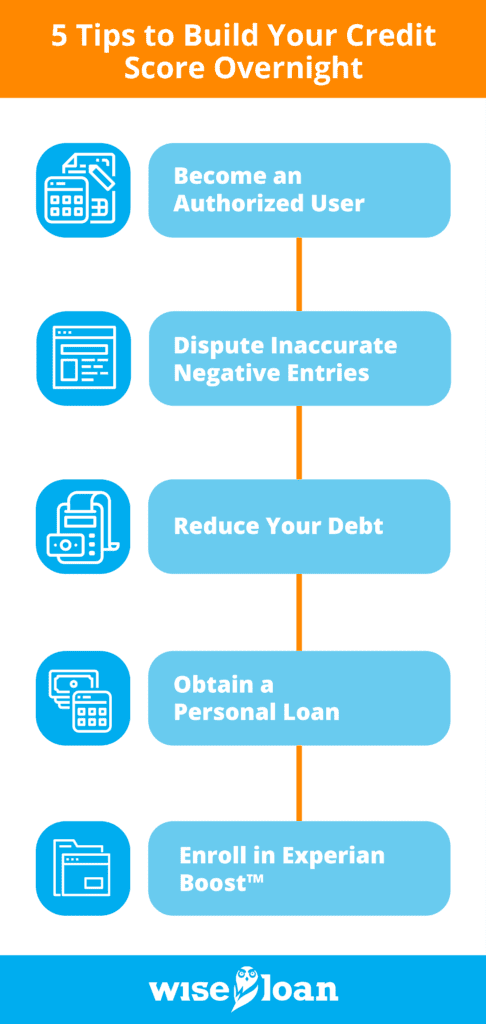

Here are five effective strategies to expedite the improvement of your credit score:

- Become an authorized user on a friend or family member’s credit card account, which can bolster your credit profile.

- Challenge and remove any inaccurately reported negative items from your credit reports, thereby rectifying errors that may be holding back your score.

- Focus on reducing outstanding debt, particularly on revolving credit accounts, as this demonstrates responsible credit management and positively affects your credit utilization ratio.

- Consider obtaining a personal loan and ensure timely repayments, as successfully managing different types of credit can enhance your creditworthiness.

- Take advantage of services like Experian Boost™, which can contribute to improving your score by factoring in other utility and telecom payment history.

By adopting these approaches, you can pave the way for a faster and more substantial improvement in your credit score. Below, we delve into each tactic in more detail to help you implement them effectively.

- Become an Authorized User

When it comes to improving your credit, most suggestions revolve around responsible debt management. However, if you lack a substantial credit history or have a low credit score, obtaining credit in the first place can be challenging. One effective workaround is to become an authorized user on someone else’s credit card account.

Here’s how it operates:

- An individual with a well-maintained credit card account adds you as an authorized user. Typically, authorized users receive a card linked to the account, enabling them to make purchases.

- There’s no obligation for you to make any transactions, and your friend or family member doesn’t even need to provide you with the card.

- When the account holder consistently makes timely payments on their credit card, these positive payment records are also reflected on your credit report.

- Ideally, this infusion of positive credit history will contribute to an improvement in your credit score.

It’s worth noting that not all credit card companies report authorized users, so conducting thorough research beforehand is crucial when utilizing this method to build your credit score.

- Dispute Inaccurate Negative Entries

Negative items such as late payments or collections accounts significantly impact your credit score. However, it’s unfair for you to bear the consequences if those items are incorrect.

Under the Fair Credit Reporting Act, you possess the right to a credit report devoid of such errors. The Federal Trade Commission offers information regarding your rights under this law, guiding you on how to order a free credit report to check for inaccuracies and dispute them if discovered. Wise Loan also provides a comprehensive guide on reading your credit report, which can assist you in this process.

Although the removal of negative items from your credit score requires an investigation that typically takes 30-45 days, a successful dispute can swiftly elevate your score.

- Reduce Your Debt

Prudent management of debt plays a vital role in maintaining a solid long-term credit score. One commonly suggested strategy for responsible debt handling is to regularly pay off or reduce your outstanding balances. This holds particularly true for revolving credit, as persistently carrying a high balance in relation to your credit limit can lower your credit score.

However, it’s never too late to make a positive impact. Paying down debt often has a positive effect on your credit score. If you make substantial progress in reducing your revolving debt, you may experience a noticeable and relatively quick improvement in your score.

Credit utilization, which refers to the proportion of your credit limit that you are utilizing, accounts for approximately 30% of your credit score, making it a significant factor. Experian recommends keeping your utilization below 30% if possible, as this is most favorable for your credit score. If you can successfully bring down your revolving debt to this threshold, you are likely to witness a rise in your score.

- Obtain a Personal Loan

In certain scenarios, your credit score may suffer due to a lack of sufficient credit history for the scoring model to assess you favorably. Alternatively, you might have primarily revolving credit, such as credit card debt. Lenders prefer to observe a track record of responsible management of diverse types of debt. Therefore, having at least one installment loan account on your credit history can prove beneficial for boosting your score.

The good news is that you don’t necessarily need an excellent credit score to qualify for such a loan. Wise Loan offers short-term personal loans that do not require exceptional credit. Additionally, they report to the credit bureaus, meaning that repaying your personal loan from Wise Loan promptly and as agreed can contribute to the gradual improvement of your credit history.

- Enroll in Experian Boost™

Sometimes, you might prefer to wait until your credit score improves before applying for a loan or credit card. In such cases, Experian Boost™ offers an excellent solution. Here’s what you should know:

Experian Boost allows you to transform your on-time payments, which you are already making, into positive credit history on your credit profile. This includes payments for utilities and streaming services.

On average, individuals experience an instant 13-point increase in their FICO® Score with Experian Boost.* Depending on your current standing, this boost could propel you into the desirable realm of good credit.

For those with thin credit files (usually comprising fewer than five accounts listed), approximately 90% witnessed a credit score increase when using this product.** Experian Boost effectively helps you add more tradelines to your credit report, providing the credit scoring model with additional data to evaluate.

Furthermore, around 70% of individuals with low credit scores (below 680) experience a rapid enhancement in their credit score by leveraging this product.**

Seize the opportunity to positively impact your credit today by signing up for Experian Boost!**

*Average boost of 13 points based on Experian data. For more details, please visit the website or app store.

**Results may vary, as some may not see improved scores or approval odds. Not all lenders utilize Experian credit files, and not all lenders use scores impacted by Experian Boost.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: