Having bad credit can lead to costly and troublesome consequences. It may hinder your chances of being approved for loans, credit cards, or even securing a rental property. Furthermore, if you manage to obtain a loan with a poor credit history, the long-term implications can be burdensome due to the likelihood of incurring higher interest rates.

Fortunately, being faced with bad credit doesn’t mean you’re trapped in this predicament. There are actionable steps you can take to tackle and overcome it.

Can You Bounce Back From Bad Credit?

Recovering from bad credit is entirely possible. The credit reporting and scoring system was never intended to permanently brand individuals as having either good or bad credit. Its primary function is to aid lenders and other entities in assessing your current creditworthiness, enabling them to make informed decisions for their businesses. As a result, the credit scoring and reporting system is dynamic and constantly evolving, offering you the opportunity to enhance your credit standing.

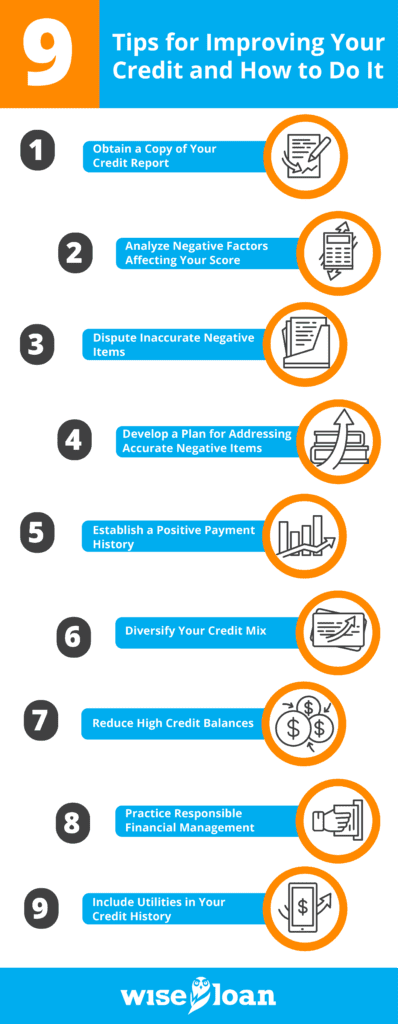

9 Tips for Improving Your Credit

Consider the following steps to repair bad credit and enhance your credit history:

- Obtain a Copy of Your Credit Report

Obtain a free copy of your credit report from each of the three major credit bureaus once every 12 months through AnnualCreditReport.com. Alternatively, you can request a copy if you’ve been denied credit or sign up for a free or paid credit reporting service.

- Analyze Negative Factors Affecting Your Score

Examine your credit reports to identify negative items that may be impacting your credit score. These may include late payments, collection accounts, hard inquiries, bankruptcies, or high credit balances.

- Dispute Inaccurate Negative Items

Exercise your right to a credit report free of errors by disputing any inaccurate information with the credit bureaus. Provide a letter explaining the dispute and include any supporting documentation.

- Develop a Plan for Addressing Accurate Negative Items

Create a plan to address accurate negative items on your credit report. For instance, catching up on overdue payments or resolving outstanding collections can positively impact your credit score.

- Establish a Positive Payment History

Work towards building a positive payment history by ensuring timely payments on existing debts, including loans, credit cards, and mortgages.

- Diversify Your Credit Mix

Maintain a mix of revolving credit accounts (e.g., credit cards) and installment loans (e.g., auto loans) to demonstrate your ability to manage different types of credit.

- Reduce High Credit Balances

Lower your credit utilization rate by paying down high balances on revolving credit accounts. Aim to keep your credit utilization below 30% of your available credit limit.

- Practice Responsible Financial Management

Sustain positive financial habits by paying bills on time, budgeting effectively, managing accounts, keeping balances low, and seeking credit from responsible lenders.

- Include Utilities in Your Credit History

Sign up for services like Experian Boost to report timely utility payments on your credit report, boosting your record of on-time payments.

FAQs About Improving Bad Credit:

– Can I pay someone to fix my credit score?

While you cannot directly pay someone to alter your credit score, you can hire credit repair services to assist you in the process. These professionals can handle tasks such as obtaining your credit reports, filing disputes, and providing guidance on improving your credit.

– How long does it take to clear a bad credit history?

Most negative items remain on your credit report for at least seven years. However, their impact lessens over time, and you can start seeing positive changes within a few months. With consistent efforts, significant improvements can occur in less than a year.

– How can I raise my credit score from 500 to 700?

To improve your credit score from 500 to 700, focus on paying down revolving debts like credit cards, making timely payments on all accounts, maintaining a healthy credit mix, and disputing any incorrect negative items on your credit reports.

– How do you achieve an 800 credit score?

Achieving an 800 credit score requires a lengthy track record of responsible credit management. This involves consistently paying bills on time, keeping credit card balances below 30% of the credit limits, and maintaining a diverse credit portfolio.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: