Personal Loans

Securing a loan of any kind involves obtaining approval from the lender, which entails meeting certain eligibility requirements. However, determining the eligibility requirements for a personal loan is not a straightforward task, as there is no universally applicable approach.

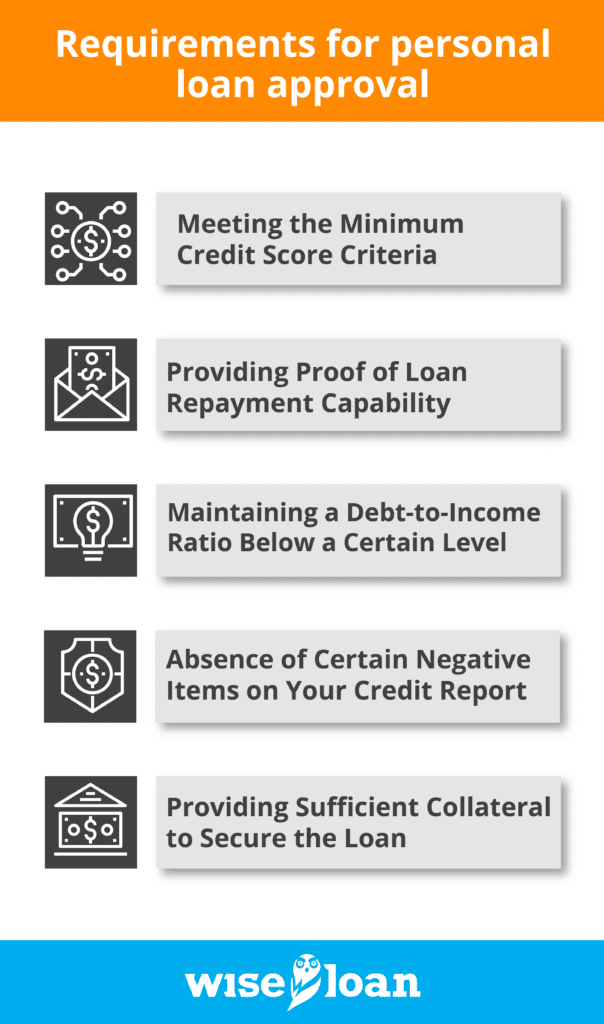

Below, we explore common types of requirements for personal loan approval and discuss how it is possible to qualify for a personal loan without meeting all of them.

Here are five commonly encountered requirements for personal loan approval, along with further explanations. It is important to note that not all lenders consider all of these factors, and being unable to meet all five requirements does not mean you cannot obtain a personal loan.

-

Meeting the Minimum Credit Score Criteria

Many loan companies have a minimum credit score requirement for approval. Typically, having a “good” credit score, usually above 660 (depending on the credit bureau), increases your chances of getting approved for credit. However, some lenders offering personal loans are willing to extend credit to individuals with credit scores below 660 or 670, which is considered the threshold for “good” credit.

Nonetheless, there is still a cutoff point, and individuals with very low credit scores may face challenges in obtaining a personal loan. Before applying for a loan, it is advisable to research the specific requirements of each lender to avoid wasting time if your credit score does not meet their criteria.

-

Providing Proof of Loan Repayment Capability

Many lenders require evidence that you can make timely payments on the loan they are granting you. Typically, this proof comes in the form of income verification. You may need to submit copies of W-2s, paycheck stubs, or tax documents to demonstrate your monthly income. Applicants must be able to provide verifiable income, as insufficient income could result in a denied loan application.

If you do not have a traditional source of income, you may need to provide documentation that shows how you will generate funds to repay the loan. This could include demonstrating self-employment income, investment income, or even having sufficient savings in an account to cover the loan payments.

-

Maintaining a Debt-to-Income Ratio Below a Certain Level

In some cases, demonstrating a certain level of income may not be sufficient. Lenders may also consider whether you have enough available funds in your monthly budget to realistically repay the debt. In such cases, they will examine your debt-to-income (DTI) ratio.

The DTI ratio represents the proportion of your total monthly debt payments to your income. The Consumer Financial Protection Bureau suggests that a DTI ratio of 43% is preferred, especially for home loans. In fact, many mortgage lenders do not approve individuals for mortgages that would exceed this percentage.

To understand how DTI is calculated, consider the following example:

Assume someone earns $3,000 per month.

Their monthly debts include:

– $500 for a car payment

– $100 for a personal loan payment

– $150 in minimum credit card payments

The total debt payments amount to $750 per month.

Therefore, the DTI ratio is $750/$3,000, which equals 25%.

Different lenders may have their own DTI requirements. If your personal loan application is rejected due to a high DTI ratio, you can take steps to reduce it, such as paying down debt or increasing your income.

-

Absence of Certain Negative Items on Your Credit Report

Some lenders may decline loan applications from individuals who have specific types of negative items reported on their credit history, particularly if these items are recent.

Again, this depends on the lender’s policies, but negative items that could hinder personal loan approval include:

– Numerous late payments or a consistent pattern of late payments. While one 30-day late payment on a credit report is usually not a major concern for lenders, multiple late payments or payments that are 90 or 120 days overdue may draw greater attention.

– Unresolved collections accounts. If you have allowed debt to go into collections and have not resolved it, lenders may doubt your commitment to honoring financial agreements.

– History of foreclosures or repossessions. Allowing a loan to reach a point where your property is repossessed or experiencing foreclosure may indicate to lenders that you may struggle to repay debts.

– Recent bankruptcy filings. Depending on the type of bankruptcy and the court’s approval, it may be difficult to obtain credit immediately. Lenders may also be cautious about approving a personal loan for someone who has recently declared insolvency, as it indicates an inability to repay debts.

However, none of these factors are necessarily insurmountable obstacles when it comes to obtaining a personal loan, especially if they occurred several years ago rather than recently.

-

Providing Sufficient Collateral to Secure the Loan

If you are applying for a secured personal loan, you need to offer valuable collateral. This collateral is an asset or item of value that can be used to secure the loan. In such an agreement, if you fail to make payments as agreed, the lender can take possession of the collateral and sell it to recover some of their losses.

In some cases, the lender retains possession of the collateral. For instance, a pawn shop loan involves giving an item of value to the pawn shop in exchange for a loan. The shop keeps the item for a predetermined period, returning it when the loan is repaid. If the loan is not repaid, the pawn shop can sell the item.

In other cases, the borrower retains possession of the collateral, and the lender only takes possession if the loan defaults. For example, a personal loan secured by the title of a boat or recreational vehicle operates in this manner.

Obtaining a Personal Loan Even If You Don’t Meet the Requirements

If these requirements seem daunting due to limited credit history or past financial setbacks, there are loan products available that do not require meeting all or some of these eligibility requirements.

Wise Loan is an example of a lender that does not require an excellent credit score or extensive credit history. With basic information about your income, a checking account, and identification, you may qualify for a personal loan from Wise Loan.

To learn more about how Wise Loan loans work and to submit an application, please visit their website today.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: