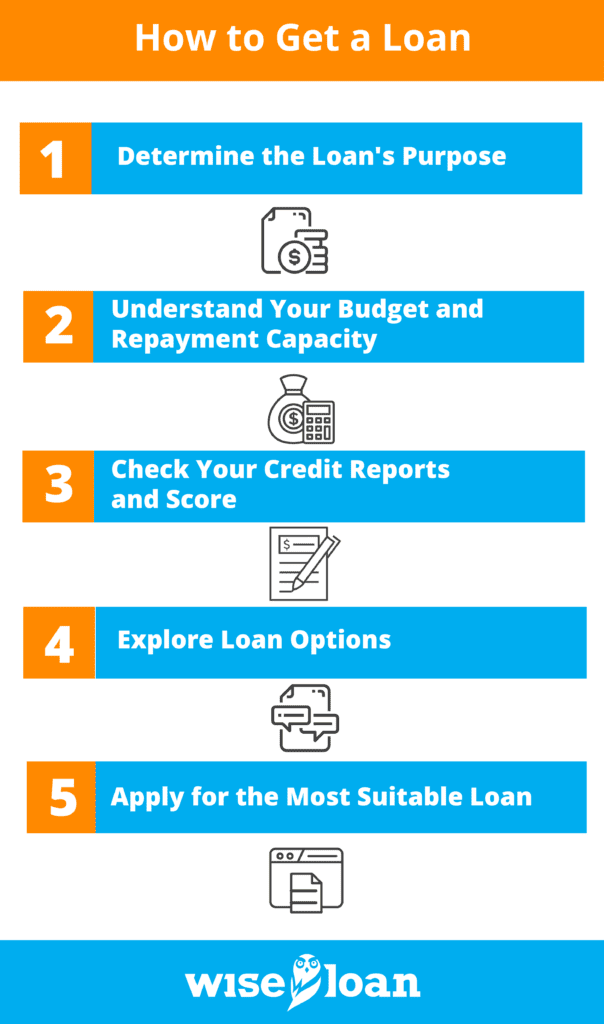

Obtaining a loan serves various purposes, such as establishing a credit history or making a significant purchase that isn’t feasible with available cash. However, if you’ve never taken out a loan before, you might be uncertain about the requirements for approval. Discover more about the step-by-step process of obtaining a loan below.

- Determine the Loan’s Purpose

The initial step in securing a loan is identifying the reason behind your need and how you plan to use the funds. This step is crucial because the type of loan you apply for depends on this information.

For instance, if you intend to purchase a car, a short-term loan of $1,000 is unlikely to be of much help. However, if you need to cover unexpected expenses like HVAC repairs for your home or you aim to diversify your credit mix and enhance your credit, a short-term personal loan might be the ideal choice.

During this evaluation, it’s important to be realistic and consider whether you truly need a loan. While you can obtain a loan for nearly any legal purpose, it’s essential to assess whether the purpose justifies the associated costs. Loans are not free money; you pay them back with interest on the borrowed amount.

- Understand Your Budget and Repayment Capacity

Once you have determined the necessity of the loan, take the time to evaluate how much of the loan you can genuinely afford. It is critical to ensure that you can meet the loan’s repayment terms, whether they involve monthly or biweekly installments.

Meeting your payment obligations promptly can help you build credit and positively impact your credit score. Failure to make payments can result in negative items being reported on your credit reports, leading to a lower score and potential difficulties in obtaining future loans.

Missed payments may also result in your account being sent to collections, potentially leading to legal action and wage garnishment. To avoid such issues, it is advisable to establish a budget before applying for a loan. If you don’t already have one, create a budget to determine the amount you can afford to borrow and repay.

- Check Your Credit Reports and Score

While it is possible to secure a loan with no or poor credit, it is helpful to know your credit standing before applying. Your credit score is a three-digit number that lenders use to assess your likelihood of repaying debts as agreed. A higher score indicates a lower perceived risk for lenders, while a low score suggests a higher level of risk.

Some lenders may decline your application if your credit score falls below a certain threshold. Others may offer loans to individuals with bad credit, but such loans often come with less favorable terms, such as higher interest rates that increase the overall cost of borrowing.

Reviewing your credit reports and scores allows you to achieve a few important objectives. Firstly, you can gauge your creditworthiness and determine the types of loans for which you may qualify. Secondly, you can examine your credit report for any inaccuracies and take steps to rectify them, thus potentially improving your credit score before applying for a loan.

To initiate this process, obtain your free credit reports from AnnualCreditReport.com. You are entitled to one free report from each of the three major credit bureaus annually. During the COVID-19 pandemic, AnnualCreditReport.com and the credit bureaus have temporarily made free credit reports available on a weekly basis to help individuals better manage their finances.

Thoroughly review these reports to ensure the accuracy of the information presented. If you come across any inaccuracies, you can dispute them with the relevant credit bureau. Correcting any erroneous negative information is one of the most effective ways to enhance your credit score.

Please note that the free reports obtained from AnnualCreditReport.com do not include your credit score. To view your credit score before applying for a loan, you can utilize services like Experian Boost.

- Explore Loan Options

Once you have determined the type of loan you need, assessed your repayment capacity, and evaluated your credit profile, it’s time to research available loan options. Consider the following factors:

Credit requirements: Check the credit criteria set by the lenders. If a certain lender requires excellent credit for approval, it is not advisable to apply if you have only fair credit. Applying for a loan generates a hard inquiry on your credit report, which can slightly lower your credit score. Multiple hard inquiries within a short period can make it more challenging to obtain credit, so it’s best to limit unnecessary applications.

Terms and interest rates: While you may not know the precise terms until you apply and get approved, gather as much information as possible. Many lenders provide details about rates and terms on their websites, enabling you to make an informed decision before applying for a loan.

Credit reporting: If your goal is to build credit, select a lender that reports payment information to the credit bureaus. This ensures that timely payments on your loan contribute positively to your credit history, potentially improving your credit score. Wise Loan, for example, reports to two of the three major credit bureaus.

Application requirements: Typically, you will need a valid form of identification, a bank account for loan disbursement, and a valid address and email address. Some lenders may have additional requirements, so ensure you are aware of them and can fulfill them before applying.

- Apply for the Most Suitable Loan

After conducting thorough research to identify the loan that best meets your needs, it’s time for the straightforward part: completing the application. Online loan applications can often be completed within minutes. Wise Loan, for instance, offers a simple application process that takes just a few minutes. If you qualify for the loan and apply early in the day, you may even be eligible for instant funding, allowing you to access your funds on the same day. Instant funding is available to applicants who are approved before 5:30 pm CT and possess a Visa or Mastercard debit card linked to their checking account. However, the speed of fund availability depends on your financial institution’s processes.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: