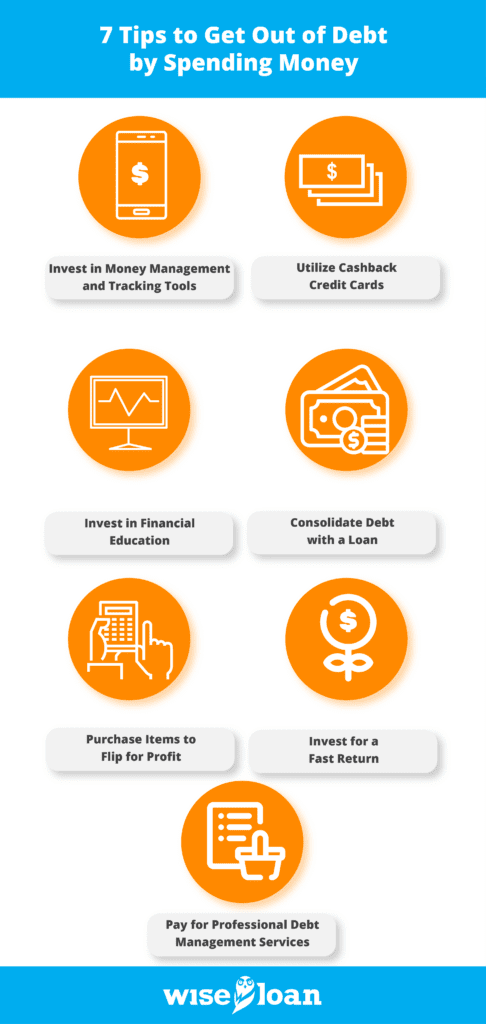

Getting out of debt can be a challenging task, especially if you haven’t received a monetary windfall. While many debt payoff strategies focus on saving money, sometimes spending wisely can help you make progress. Here are seven tips for getting out of debt by spending money, each with its pros and cons:

- Invest in Money Management and Tracking Tools

Use apps and technical tools to organize your finances, set reminders for debt payments, and accelerate your debt payoff process. The Tally app automates credit card payments, and Mint helps with budgeting.

Pros: Affordable subscriptions, numerous options, and better financial visibility.

Cons: Requires effort and discipline to implement effectively.

- Utilize Cashback Credit Cards

Opt for credit cards with cash back rewards to cover regular expenses and use the cashback to pay off debt. Ensure you pay off the credit card balance promptly.

Pros: Cashback acts as extra money for debt reduction.

Cons: If not managed well, it may lead to increased debt.

- Invest in Financial Education

Consider enrolling in financial education programs or purchasing books by experts to improve your debt management skills and knowledge.

Pros: Helps address the root causes of debt and provides accountability structures.

Cons: Some programs can be costly, and free resources are available online.

- Consolidate Debt with a Loan

Explore debt consolidation loans to combine multiple debts into one with a more manageable monthly payment, potentially increasing your cash flow.

Pros: Simplifies debt management and allows for easier extra payments.

Cons: Not everyone qualifies, and it could lead to further debt if not managed wisely.

- Purchase Items to Flip for Profit

Invest in items like houses, cars, or vintage clothing, fix them up, and sell them at a profit to use the proceeds for debt repayment.

Pros: Engaging and enjoyable way to earn money to pay down debt.

Cons: Requires upfront investment, effort, and no guaranteed profit.

- Invest for a Fast Return

Consider investing in stocks or cryptocurrencies for a quick profit, which can then be used to pay off debt.

Pros: Potential for fast returns in a short period.

Cons: Risky investments with the possibility of losing money.

- Pay for Professional Debt Management Services

In challenging situations, seek assistance from financial advisors or debt management companies to negotiate with debt collectors on your behalf.

Pros: Expert help and negotiation skills.

Cons: Expensive services with no guarantees and potential for redundant efforts.

If you find the idea of a debt consolidation loan appealing, you can explore options with Wise Loan for your debt management needs.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.