In a recent survey of 500 of our customers, it was discovered that many individuals highly value the convenience of obtaining a self-serve loan online. Below, we will delve into the concept of self-serve loans, explaining why they are so attractive and providing guidance on how to obtain one.

What Does a Self-Serve Online Loan Entail?

A self-serve loan is precisely what it sounds like: a loan that requires minimal interaction and primarily involves do-it-yourself steps.

Think of it as similar to the self-checkout option at a grocery store. You are acquiring food from the store, not growing or raising it yourself, but you are not engaging in conversation with a cashier or having someone else scan and bag your items.

Similarly, with a self-serve loan, you can complete an online application without the need to communicate with anyone. Following that, you will be notified of your approval status via a message on the website or through email, and the funds will be sent to your bank account without the requirement of any further interaction.

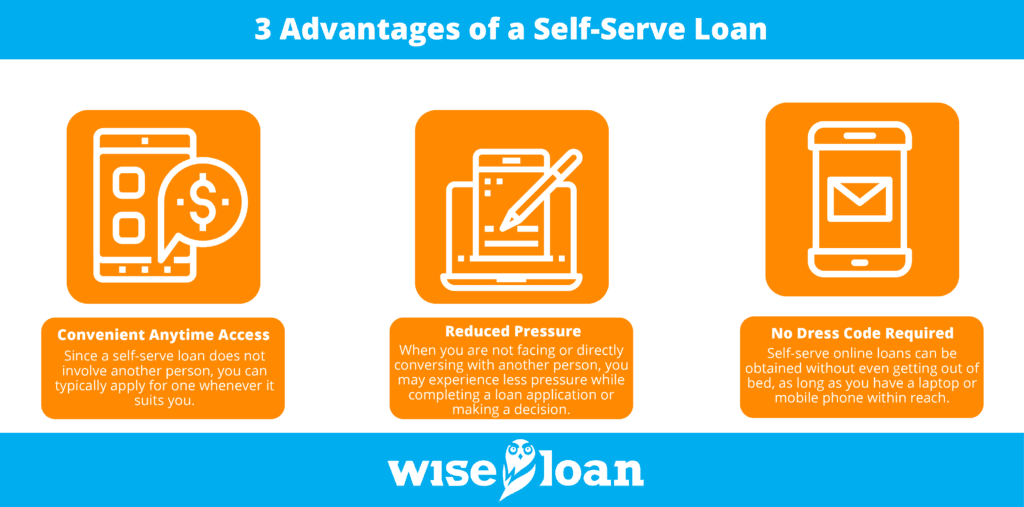

3 Advantages of a Self-Serve Loan

The benefits of a self-serve loan depend on your personality and objectives. Some individuals simply prefer to limit interactions with strangers unless necessary and appreciate a product that enables them to handle important financial matters independently. Here are some additional potential advantages of a self-serve loan:

- Convenient Anytime Access

Since a self-serve loan does not involve another person, you can typically apply for one whenever it suits you. Whether you realize on a weekend that you require funding or an installment loan to build your credit, you can easily complete the application process at your convenience. This way, you won’t postpone or forget about it when your busy workweek schedule sets in.

Alternatively, you might find yourself contemplating solutions for a financial emergency late at night. The ability to apply immediately and promptly receive approval or rejection can provide peace of mind, allowing you to get the restful sleep you need.

It is important to note that although you can apply for these online loans at any time, the funding process usually follows banking hours. You may need to wait for the bank’s scheduled deposit times to access your funds unless you receive instant funding through a debit card.

- Reduced Pressure

When you are not facing or directly conversing with another person, you may experience less pressure while completing a loan application or making a decision. This can make the entire process less stressful for you.

- No Dress Code Required

In fact, you don’t need any clothing at all, nor do you have to deal with the hassle of getting your children dressed and buckled into the car or battling traffic. Self-serve online loans can be obtained without even getting out of bed, as long as you have a laptop or mobile phone within reach. This makes the process less bothersome, stressful, and time-consuming.

Possible Drawbacks of a Self-Serve Loan

There are not many disadvantages to obtaining a self-serve loan online. However, since you are not interacting with anyone during the application and loan selection process, you are solely responsible for conducting research and making informed decisions. This could potentially put you at a slight disadvantage, as you might not be aware of all the available options and could end up choosing a suboptimal one.

This drawback is more significant for individuals who are not familiar with credit, installment loans, and financing. Therefore, if you intend to take the self-serve route, we recommend visiting the Wise Loan blog first and exploring some of our educational posts to gain a better understanding before you proceed with your application.

Who Might Benefit from a Self-Serve Online Loan?

Individuals who are seeking immediate loan approval and a prompt response may find a self-serve online loan appealing. If you have an urgent financial need and possess a good understanding of credit and installment loan options, this can be an advantageous approach. Additionally, if you prefer to avoid interacting with strangers, a self-serve loan offers an ideal solution. It allows you to maintain your introverted nature while still pursuing and obtaining financial assistance.

Can You Obtain a Self-Serve Loan with Wise Loan?

Regrettably, our services are not available in all states. However, if you reside in one of the following states, you can apply for a self-serve loan with Wise Loan:

To successfully apply for a loan with Wise Loan, there are a few requirements. Firstly, you must have a qualifying bank account. Once your loan is approved, Wise Loan will deposit the funds into your checking account. If you wish to apply for a loan with instant funding, you will need a qualifying bank account with a linked debit card, as the debit card will be used to receive the instant funds.

Additionally, you will need to provide proof of address to demonstrate that you are a resident of the respective state. Some personal information, and possibly details about your income, will also be required. In most cases, Wise Loan does not demand extensive document submission, and we do not require a good credit score for loan approval.

Why Should You Apply with Wise Loan Today?

The primary reason most individuals choose to apply is to access the funds they require. A self-serve loan with Wise Loan enables you to quickly obtain the necessary funds once your application is approved.

Another compelling reason to apply with Wise Loan is to improve your credit. We report to two out of the three major credit bureaus, helping you establish a positive payment history that benefits your credit score. Just ensure that you make your payments on time and as agreed!

To facilitate financial management for our customers, we offer incentives for responsible behavior. When you fully repay your installment loan, you gain access to a bonus reward deposited in a Nest Egg account. The reward amount ranges from $10 to $50 for every $1,000 borrowed, and you can choose to receive it as a cash payment in your bank account or use it to secure another loan.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: