Payday loans are intended to provide assistance during unforeseen emergencies or financial needs, offering short-term loans typically in smaller amounts. It is crucial to be well-informed about payday loans and alternative options in order to make the most suitable financial decision for yourself or your family when confronted with such circumstances.

Continue reading to discover additional information about online loans and identify the optimal choice for a “payday loan.”

This post will cover the following topics:

- Legitimate online loans: Are they available?

- The easiest loan to get approved for: What are the options?

- Best online payday loan: Which one is recommended?

- Frequently asked questions about online loans.

Are There Legit Online Loans?

Absolutely, there are numerous reputable lenders that provide online loan services. Whether you require personal, car, mortgage, or student loans, you can explore various options online. In fact, many major banks now offer fully digital services to cater to their customers’ needs effectively.

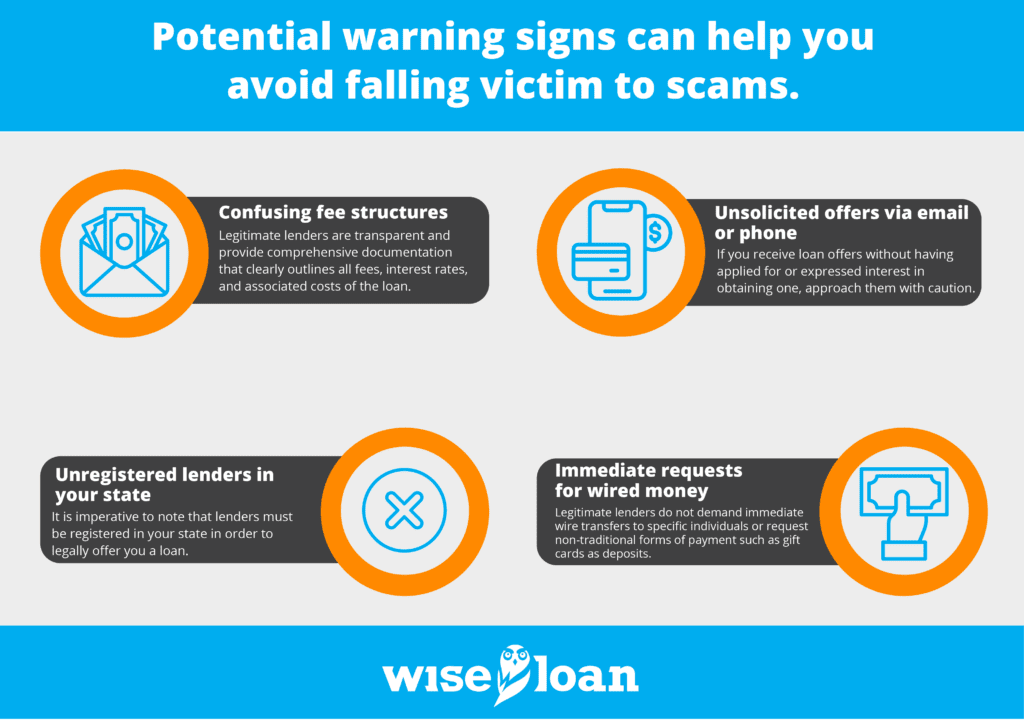

However, it is crucial to remain cautious as there are indeed fraudulent activities related to online loans. Being aware of potential warning signs can help you avoid falling victim to scams. Here are some red flags to watch out for:

- Confusing fee structures: Legitimate lenders are transparent and provide comprehensive documentation that clearly outlines all fees, interest rates, and associated costs of the loan. They are also readily available to address any queries you may have, ensuring that you fully understand the financial implications. If a lender appears unwilling to discuss these aspects or provides explanations that intentionally confuse or complicate matters, it should raise concerns.

- Unsolicited offers via email or phone: If you receive loan offers without having applied for or expressed interest in obtaining one, approach them with caution. This is particularly true if the timing of the offers seems too coincidental, conveniently aligning with your urgent financial needs. Scammers often scour social media and other platforms in search of individuals who are in dire need of money. They may then contact these individuals with enticing offers that are too good to be true, intending to steal money or gather personal information for identity theft.

- Unregistered lenders in your state: It is imperative to note that lenders must be registered in your state in order to legally offer you a loan. If a lender is not registered, they should not be extending loan offers to you.

- Immediate requests for wired money: Legitimate lenders do not demand immediate wire transfers to specific individuals or request non-traditional forms of payment such as gift cards as deposits. Such requests should raise suspicions.

By remaining vigilant and recognizing these warning signs, you can protect yourself from potential online loan scams.

What Is the Easiest Loan to Get Approved for?

The key to getting approved for a loan easily lies in meeting the necessary qualifications. Take the time to conduct thorough research on online loans, focusing on requirements such as credit score, income, and other criteria. Here are some common prerequisites to consider:

- Residency in a specific area: Certain lenders, like Wise Loan, operate within limited states. For example, Wise Loan provides loans in Delaware, Idaho, Louisiana, Mississippi, Missouri, South Carolina, Texas, Utah, and Wisconsin. If you reside outside of these states, approval for a loan from Wise Loan would not be possible.

- Credit score: Many lenders establish a minimum credit score requirement. Falling below this threshold could lead to automatic rejection. However, Wise Loan stands out by not emphasizing good credit and working with individuals across all credit histories. Moreover, they assist borrowers in building credit by reporting timely payments to two of the three major credit bureaus.

- Adequate income: It is essential to ensure that you possess sufficient income to meet the loan payments. To verify this, many lenders request proof of income.

- Checking or savings account: Online loans are commonly disbursed through transfers to a checking or savings account. Without one of these accounts, you may not be able to receive funds even if your loan application is approved.

- Photo ID: Most lenders require applicants to provide a photo ID for identity verification. This typically involves uploading a picture of an approved form of identification.

By familiarizing yourself with these requirements and ensuring you meet them, you can increase your chances of getting approved for an online loan smoothly.

What Is the Best Online Payday Loan?

The optimal choice for an online loan may not necessarily be a payday loan. When comparing traditional payday loans with installment loans like those provided by Wise Loan, it becomes evident that installment loans offer more advantages and fewer drawbacks.

Ultimately, the best loan for you is one that satisfies the following criteria:

- Affordability: Carefully examine the loan terms and conditions to ensure you avoid falling into a cycle of payday loans that can trap you in a cycle of increasingly costly rollovers. Instead, consider installment loans that offer manageable weekly, biweekly, or monthly payments.

- Lower fees or interest rates: Take the time to compare different loan options and select the one with the most favorable rates. If you have less-than-perfect credit, accessing the best rates on the market may not be feasible, but you can still find the most favorable rates available to you.

- Credit reporting to all three bureaus: This aspect is particularly important if you aim to build your credit for the future. Wise Loan, for instance, reports to all three major credit bureaus, enabling you to demonstrate your ability to make timely bill payments. This can have a positive impact on your credit score.

If you seek a short-term loan that avoids trapping you in a payday loan cycle and helps you enhance your credit, consider applying for a Wise Loan today.

Online Loan FAQs

How can you obtain immediate cash?

You can secure almost instant cash through online loans that offer immediate funding options. To begin, you must meet the loan eligibility criteria. Wise Loan provides options that do not require excellent credit.

Next, it is important to apply early in the day to ensure same-day or instant funding. For the best results, try submitting your application before lunchtime.

Lastly, having a checking account linked to a Visa or Mastercard debit card is typically necessary. This is because instant funds are transferred through the card networks, which is faster than traditional ACH transfers that can take a day or longer to process.

How do online loans function?

Online loans operate similarly to any other loan, with the key difference being that the approval and funding process occurs through digital methods instead of in-person interactions. You need to complete an application, which the lender reviews based on its approval guidelines. If you meet the requirements, you can be approved for the loan. Funds are typically disbursed through electronic funds transfer or other digital channels.

Which online loan is the fastest?

The fastest online loan is one with minimal requirements, an easy application process, and the option for instant funding. Wise Loan offers this type of loan. Learn more about their instant funding option.

How can you obtain a loan when no lender is willing to approve you?

Building credit can be challenging due to a Catch-22 situation. Good credit is often necessary to get approved for various loans, but you need a loan to establish good credit. Here are some ways to overcome this predicament:

– Apply for a loan that does not require excellent credit, such as those offered by Wise Loan.

– Ask a trusted individual with good credit to cosign a loan for you.

– Wait until you have time to improve your credit by consistently making timely payments on existing debts and reducing balances on credit cards.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: