Discover the versatile applications of installment loans, which serve as an excellent financial resource. These loans enable you to conveniently distribute the burden of a substantial expense across several months or even years, accommodating your budget through manageable monthly payments. Furthermore, they offer the added benefit of aiding in the development of your credit score, providing a foundation for future financial endeavors.

Explore the diverse possibilities of utilizing an installment loan with the following options.

What Is an Installment Loan?

To better comprehend the different types of installment loans, it is essential to have a clear understanding of what installment loans entail and how they differ from other forms of debt. In simple terms, an installment loan refers to a debt that you repay through periodic installments, which are predetermined payments agreed upon in advance.

Here’s how it typically works:

- You acquire a certain amount of debt, such as a personal installment loan totaling $3,000.

- The lender assesses various factors, such as your credit history, income, and loan amount, to determine the interest rates and terms for the loan.

It’s important to note that an installment loan stands in contrast to another common type of debt known as revolving credit. In the case of revolving credit, you are assigned a specific credit limit that allows you to borrow against it and repay it in a revolving manner. This often results in fluctuating balances, where you may owe more or less over time. Examples of revolving credit include credit cards and home equity lines of credit.

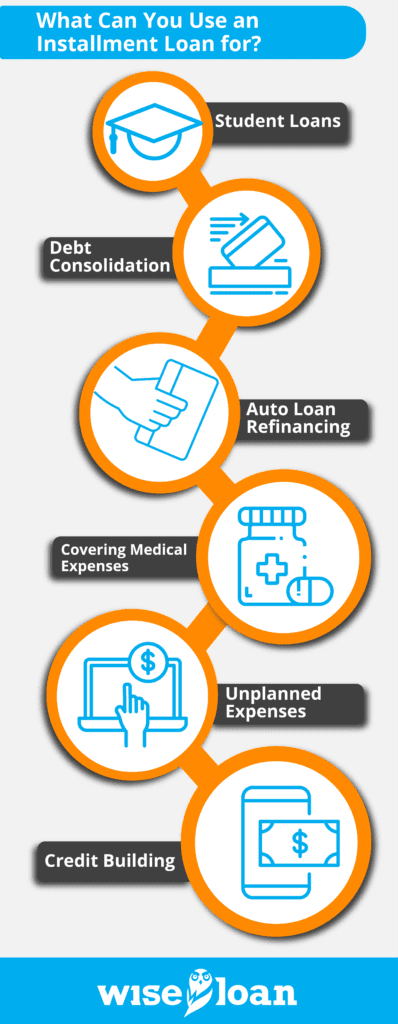

What Can You Use an Installment Loan for?

Here are alternative ways to express the provided information:Not only are student, auto, debt consolidation, and personal loans common examples of installment loans, but there are also other diverse applications for these types of loans. Consider the following six scenarios in which you might utilize installment loans:

1 Student Loans

Whether you opt for a government-backed loan obtained through the FAFSA or choose a private lender, all student loans fall under the category of installment loans. The terms and conditions vary depending on the type of loan and factors such as your personal credit history.

Loans offered by the Department of Education, such as Direct Subsidized and Unsubsidized loans, have interest rates determined annually by the federal government. For instance, the interest rates for federal student loans issued between July 1, 2020, and July 1, 2021, range between 2.75% and 5.30%, depending on the loan program and purpose.

Private student loan interest rates, on the other hand, depend on the borrower’s credit score, income, and existing debt, as well as any cosigner involved. Regardless, when repaying student loans, you are expected to make regular monthly installments.

2 Debt Consolidation

Debt consolidation loans serve the purpose of combining multiple debts, often those with higher interest rates, into a single loan. The objective is to streamline debt management while potentially reducing the long-term cost.

This method is frequently employed to consolidate high-interest revolving debt, such as credit card balances, allowing for quicker repayment or a more manageable payment schedule based on your budget.

3 Auto Loan Refinancing

Refinancing an existing auto loan presents another opportunity to leverage an online installment loan to save money. If you initially secured the loan when your credit score was less favorable due to limited options but have since improved your creditworthiness, you can refinance at a lower interest rate, thereby reducing the overall loan cost.

Alternatively, you may choose to refinance simply because you prefer to work with a different financial institution. Various reasons exist for obtaining an installment loan to refinance an existing auto loan.

4 Covering Medical Expenses

When faced with significant medical or dental expenses that surpass insurance coverage, financing options can come into play. Some providers collaborate with services or banks that offer installment loans specifically for this purpose, while online installment loans can also be obtained. Personal loans obtained online generally provide flexibility in how you utilize the funds, including covering medical bills.

5 Unplanned Expenses

Unforeseen expenses extend beyond medical bills. You may encounter costly car repairs, a malfunctioning air conditioner during the summer, or the need to replace a household appliance. In such instances, an open installment loan can serve as an effective solution. As illustrated earlier, this option tends to be more cost-effective than accumulating high-interest credit card debt, especially if you are unable to promptly settle the purchase.

6 Credit Building

In certain cases, an installment loan can be instrumental in establishing and improving your credit. Two primary reasons support this notion.

Firstly, making timely debt payments significantly influences your credit score. However, if you lack sufficient debt-related history, there is no basis to evaluate your payment reliability. Taking out a small personal installment loan and repaying it as agreed can aid in establishing a positive credit history.

Secondly, credit mix is another aspect considered in credit scoring. Lenders prefer to see that you can responsibly handle various forms of debt. Therefore, having a diverse credit history comprising both revolving credit (e.g., credit cards) and installment loans is advantageous. If your credit report primarily consists of credit cards, obtaining a personal loan or auto loan can introduce an installment loan to enhance your credit profile.

Discover the Ideal Loan for Your Needs

The key to finding the perfect loan lies in selecting one that aligns with your requirements and allows you to repay it according to the agreed terms. Naturally, you would prefer an installment loan that offers favorable rates tailored to your specific circumstances. Here are some valuable tips to assist you in locating the best installment loan:

- Assess your credit standing: Begin by examining your credit score to determine where you currently stand. If your credit is less than ideal, your loan options may be limited, potentially resulting in higher interest rates.

- Determine the required amount and purpose: Clearly define the amount of money you need and the purpose behind it. Being able to convey this information to the lender can be helpful throughout the application process.

- Conduct thorough research: Explore different loan options that you believe you qualify for. It is advisable to refrain from applying for numerous loans simultaneously, as each application can generate a hard inquiry on your credit report, which may slightly impact your credit score.

- Apply for selected loans: Choose one or two loans that seem suitable for your needs and submit your applications accordingly.

If you seek a loan process that is hassle-free and streamlined, consider Wise Loan as an excellent option.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: