There are several financial benefits to paying off your personal loan early. Depending on the structure of your loan, you can potentially save a significant amount in interest costs. Moreover, paying off the loan ahead of schedule frees up the money you would normally spend on monthly payments, providing extra cash for your budget.

However, it’s crucial to understand the potential impact of early loan repayment on your credit score and consider any other downsides involved. To gain more insight into paying off a personal loan early, including tips to minimize potential disadvantages, continue reading below.

Is it Possible to Pay Off a Personal Loan Early?

Yes, you have the option to pay off your personal loan before the scheduled term ends. Nevertheless, the more important question is whether it is advisable to do so. It is essential to carefully evaluate the pros and cons specific to your situation before deciding to pay off your personal loan ahead of time.

To make an informed decision about early loan repayment, it’s helpful to consider both the general advantages and disadvantages that may apply in your case.

| Advantages of Early Personal Loan Repayment | Drawbacks to Consider When Paying Off a Personal Loan Early |

| You might save interest. By paying down the principal of your loan at an accelerated rate compared to the initial plan, you have the potential to minimize the interest you pay. The reason behind this lies in the fact that interest is computed based on the principal amount, so when you make early payments towards reducing the principal, the interest is calculated on a smaller sum. The extent of your savings in interest payments can vary depending on the structure of your loan and your ability to repay it swiftly. It is possible to save hundreds or even thousands of dollars in interest by adopting this approach. |

There is a possibility of incurring penalties.

Certain lenders incorporate penalties within the loan arrangement, which may result in you being charged fees if you attempt to repay the loan ahead of schedule. They implement this practice because early loan repayment means you pay them less in interest. Since interest serves as a primary source of income for lenders, some include additional fees in the loan structure to guarantee that they receive some compensation regardless of whether or not they repay the loan early. |

| You gain financial flexibility on a monthly basis.

By repaying your personal loan ahead of schedule, you can retain a larger sum of money in your monthly budget. For instance, if your monthly payments amount to $200, that’s an additional $200 that you can allocate towards savings. Not only can you potentially earn interest on those savings, but initiating early repayment to free up the money as soon as possible can lead to even greater savings in the future. |

You may impact your credit mix.

Your credit score comprises various factors, including your credit mix. Lenders prefer to observe a balanced combination of installment and revolving debts, indicating your ability to manage different types of credit. If your personal loan constitutes your sole installment account and you choose to repay it early, the lender will close the account. Consequently, you will no longer have an active installment account listed on your credit report, potentially leading to a reduction in your credit mix. |

| You lower your debt-to-income ratio.

When assessing your creditworthiness, lenders often take into account your debt-to-income ratio, particularly for significant loans like mortgages or auto loans. Your debt-to-income ratio is a measure of how much of your monthly income goes toward debt payments. To secure approval for a mortgage, it is typically necessary for your debt-to-income ratio to remain below a certain threshold. Paying off a portion of your debt early can assist you in meeting this requirement and reducing your debt-to-income ratio. |

You could potentially raise your credit utilization rate.

Closing your personal loan account effectively eliminates a line of credit from your credit report. As a result, your credit utilization rate may increase, potentially influencing your credit score. |

| You can have peace of mind regarding the loan.

Life can become hectic, and managing numerous financial obligations can add to your personal workload. Simplifying your money management by reducing the number of monthly bills can contribute to more effective outcomes. By alleviating the concern of an additional loan to pay, you can experience a greater sense of ease and tranquility.

|

You could potentially decrease your overall credit history length.

Credit age is a significant factor in determining your credit score, considering both the length of time you’ve had credit and the average age of your various accounts. If your personal loan happens to be one of your older accounts and you choose to pay it off, it can result in a reduction of your overall credit history length. |

Determining whether to pay off your personal loan early depends on how these factors align with your current financial circumstances.

For instance, if your primary objective is to save on interest costs, it is essential to perform thorough calculations. Begin by precisely determining the potential amount of savings you may achieve. Next, assess the costs associated with paying off the personal loan, such as prepayment penalties and any potential impact on your credit. Consider the potential consequences of an impact on your credit if you plan to apply for a new credit card or loan in the near future, as it could result in higher interest rates and increased expenses at that time. In such cases, the drawbacks of early loan repayment may outweigh the benefits.

On the other hand, if you are preparing to apply for a mortgage and need to decrease your debt-to-income ratio, the advantages of paying off your personal loan early may outweigh the disadvantages. Ultimately, it is a decision that requires careful consideration of all the pertinent details regarding your situation and the specific loan in question.

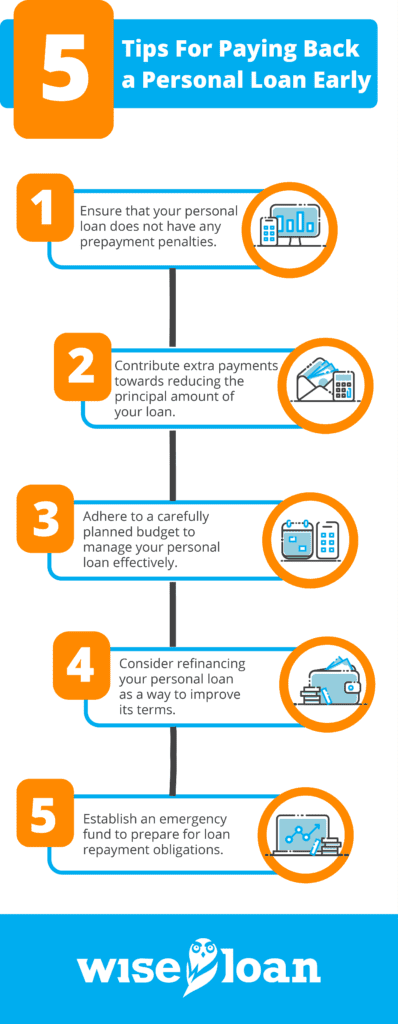

5 Tips for Paying Off Your Personal Loan Early

If you determine that paying off your personal loan ahead of schedule is a viable choice for your circumstances, follow the steps outlined below to enhance your chances of success.

- Ensure that your personal loan does not have any prepayment penalties.

To begin, carefully review your loan documentation to identify any potential prepayment penalties. These penalties are charges imposed by lenders to recover some of the interest you would have paid if the loan had been repaid over its entire term.

It is important to note that not all personal loans entail prepayment penalties. Furthermore, these fees must be disclosed and included in the written loan documentation before you sign the agreement. Lenders cannot suddenly impose these fees if you decide to repay your loan early and they haven’t previously informed you about them.

The presence of prepayment penalties should not automatically dissuade you from paying off the loan early. However, it can affect the total amount you need to pay for early repayment. It is crucial to assess the overall cost of these penalties in comparison to the expenses associated with paying off your loan over the entire term. This analysis will help you determine the most financially advantageous option in the long run.

- Contribute extra payments towards reducing the principal amount of your loan

If you are unable to pay off a loan in one lump sum, making extra payments on the principal balance is a common approach to repay it early. While it may not be as expedient as a full payoff, it can still be effective.

There are two primary methods to achieve this. First, you can increase the amount you pay each month, such as paying $150 instead of the required $125. The additional $25 goes directly towards reducing the principal balance. Alternatively, you can make two payments of $125 per month, with the second payment solely allocated to the principal balance.

When making extra payments in this manner, it is crucial to ensure your lender recognizes that the additional funds are intended for the loan’s principal. Otherwise, they may apply the extra amount towards the next month’s payment, which means some of it will be used to cover interest rather than reducing the principal balance.

Many lenders offer options to make direct payments towards the principal balance, as long as you remain current with your regular payments. If you mail a check in response to a bill or use a tear-out ticket from a book, there is typically an option to specify whether the extra amount should be applied to the principal. Similarly, most online payment platforms ask if any extra payment should be allocated to the next payment or the loan’s principal balance.

It is important to note that making extra payments toward the principal balance does not exempt you from your scheduled loan payments. You are still obligated to make the agreed-upon payments, and failure to do so can result in late charges or additional expenses.

- Adhere to a carefully planned budget to manage your personal loan effectively.

Achieving early repayment of a personal loan necessitates allocating more funds towards it than originally planned. This may require identifying additional cash within your budget.

Review your monthly expenses and compare them with your income to identify potential areas where you can allocate extra money towards your personal loan each month. This can be accomplished by reducing unnecessary expenses, such as dining out, or by increasing your income through part-time work in the gig economy.

Regardless of how you generate the funds for additional loan payments, your success hinges on adhering to your plan. Monitor your income and expenses on a monthly basis to ensure you stay within your budget and can consistently make extra payments towards your loan, thus facilitating early repayment.

- Consider refinancing your personal loan as a way to improve its terms.

In certain situations, paying off your personal loan early can be accomplished without relying on your existing budget. This can be achieved through a process known as loan refinancing, wherein you secure a new loan to replace the existing one.

It’s important to note that refinancing does not eliminate your personal loan payment entirely. However, it can lead to reduced overall costs or lower monthly payments. This is particularly true when the original personal loan carried exceptionally high-interest rates or unfavorable terms. If your credit situation has improved since obtaining the initial loan, refinancing can potentially allow you to secure a new loan with more favorable rates and terms. This has the potential to result in significant long-term savings.

- Establish an emergency fund to prepare for loan repayment obligations.

Lastly, it is advisable to refrain from utilizing your emergency fund or depleting personal savings to pay off a personal loan ahead of schedule. Although it may seem like a money-saving approach in the short term, consider the potential consequences if an unforeseen emergency arises. Without sufficient cash reserves, you may find yourself compelled to resort to high-interest credit alternatives, ultimately leading to increased long-term expenses.

Does Paying Off Your Personal Loan Impact Your Credit Score?

Yes, paying off your personal loan before its scheduled term can indeed influence your credit score. Generally, this impact tends to be negative and may cause a temporary decrease in your score. This is because paying off a loan early can lead to the following outcomes, as mentioned in the earlier section:

- Increased credit utilization

- Lower credit age

- Reduced credit mix

It is important to note that this differs from the impact of paying down a credit card balance. Decreasing your credit card balance can actually improve your credit utilization ratio because the account remains open, allowing you to retain the associated credit line, credit age, and credit mix.

The positive news is that if you demonstrate responsible financial behavior and actively work towards enhancing your credit, any negative impact resulting from paying off a personal loan early is likely to be temporary.

If you are considering refinancing your personal loan or require a new loan subsequent to paying off a previous one, Wise Loan is here to assist you. Our responsible lending services offer quick access to the funds you require, allowing you to repay the loan while simultaneously building your credit.

The recommendations contained in this article are designed for informational purposes only. Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.