Understanding the Distinction between Secured and Unsecured Loans

Loans can be broadly categorized into two main types: secured and unsecured. It is crucial to know the type of loan you have, as their management and consequences for missed payments differ significantly. Below, we will delve into the concept of unsecured loans and explore how they contrast with secured loans.

Unsecured Loans Explained

Unsecured loans are those not backed by collateral or surety. In other words, they are not tied to any property or valuable asset, such as real estate, a home, or a vehicle.

Secured Loans Explained

On the other hand, secured loans are loans that are backed by collateral or surety, typically linked to a specific property. For instance, loans for purchasing a house or a vehicle fall under this category, where the lender holds the title until the loan is fully repaid.

In some cases, secured loans require the borrower to designate a valuable possession, like jewelry, furniture, art, or a vehicle, as collateral. If the borrower fails to make payments as agreed, the lender has the legal right to seize and sell these items to recover the losses incurred due to nonpayment.

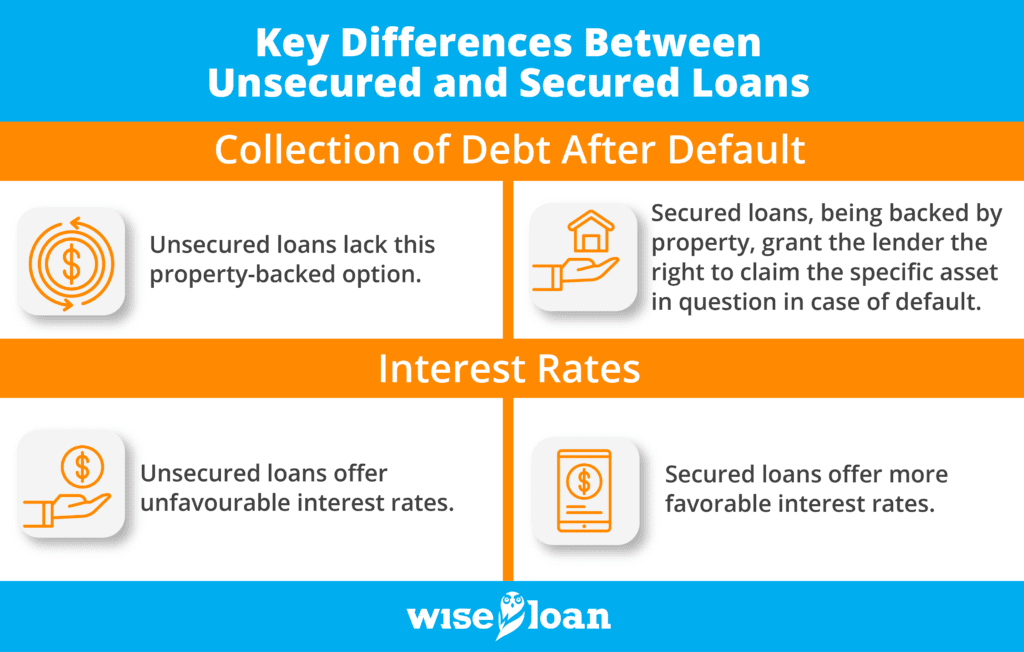

Key Differences Between Unsecured and Secured Loans:

- Collection of Debt After Default

The most significant distinction between the two loan types lies in their association with property. Secured loans, being backed by property, grant the lender the right to claim the specific asset in question in case of default. This may involve foreclosure, repossession, or seizure, depending on the loan’s terms. The lender then sells the asset to recover the unpaid debt.

In contrast, unsecured loans lack this property-backed option. In such cases, the lender pursues other collection activities, including legal action, such as filing a lawsuit and seeking a judgment. If successful, the lender or collection agency may garnish the borrower’s wages or levy their bank accounts to reclaim the owed funds.

- Interest Rates

Generally, secured loans offer more favorable interest rates compared to unsecured loans. The lower risk for the lender, backed by the presence of collateral, makes secured loans less risky, enabling lenders to provide better interest rates.

- Treatment in Bankruptcy and Other Proceedings

Secured and unsecured debts are treated differently in bankruptcy and other financial proceedings. Prioritizing secured debts in bankruptcy may allow borrowers to retain their property while discharging unsecured debts.

Deciding Between Unsecured and Secured Loans

The choice between these loan types depends on individual needs and circumstances. Unsecured personal loans can be a flexible financial tool for various reasons, such as:

– Building Credit: Obtaining an unsecured loan can help diversify your credit mix, contributing positively to your credit score. Timely repayments on such loans can also boost your credit history.

– Access to Quick Funds: Unsecured loans can be processed swiftly, offering a convenient solution for temporary financial gaps, urgent expenses, or large personal purchases.

It is essential to assess your financial situation and ability to repay the loan before applying. Choosing a reputable and responsible lender is crucial, and applying for multiple loans simultaneously should be avoided to prevent numerous hard inquiries on your credit report. If you are ready to apply for an unsecured loan, Wise Loan is here to assist you promptly.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: