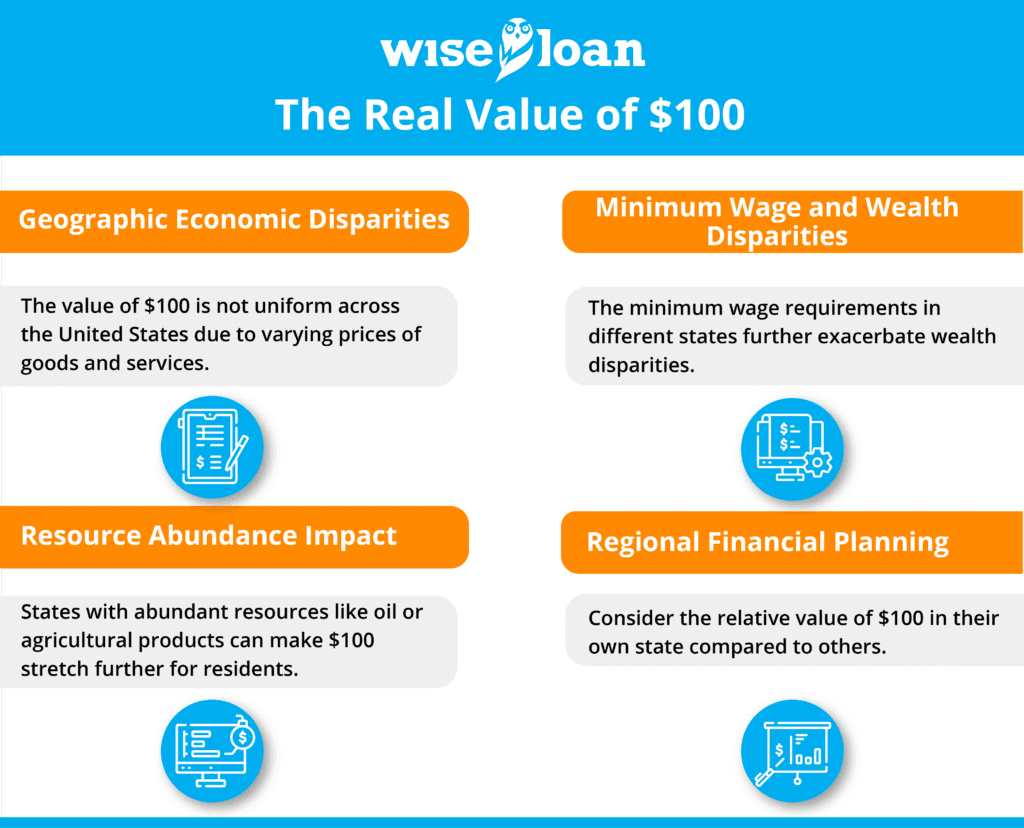

What is the true value of $100? At first glance, you might think it’s simply worth $100, but the reality is more complex. Why does the value of $100 differ from one state to another? The answer lies in the varying prices of similar goods across the United States. Your $100 won’t stretch as far in some states as it will in others. But why is this the case? It’s a result of a combination of economic, political, and social factors unique to each state.

States with a high cost of living and above-average taxes, like California or New York, diminish the purchasing power of $100. The states where $100 is worth the least are the District of Columbia ($84.60), Hawaii ($85.32), New York ($86.66), New Jersey ($87.64), and California ($88.57). Additionally, varying minimum wage requirements further contribute to the wealth disparities among states and can lead to inflation in high-cost states.

Conversely, states blessed with abundant resources, such as oil or crops, make $100 go further than in most other states. In Mississippi ($115.74), Arkansas ($114.16), Missouri ($113.51), Alabama ($113.51), and South Dakota ($113.38), your $100 packs a more substantial punch. While some of these states may have a lower standard of living, they manage to maintain lower average prices compared to the national average.

Are you curious about the relative value of $100 in your state compared to others? Click on the map below to find out. Does your state offer the most value for your money? (Source: TaxFoundation.org)

This informative article is brought to you by Wise Loan. Wise Loan provides installment loans in Texas, Utah, Louisiana, Delaware, Wisconsin, and more, and stands out as the only lender that rewards borrowers with cash back for timely loan repayments, helping you build a brighter financial future.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.

More information on Installment Loans and how they work in your state: