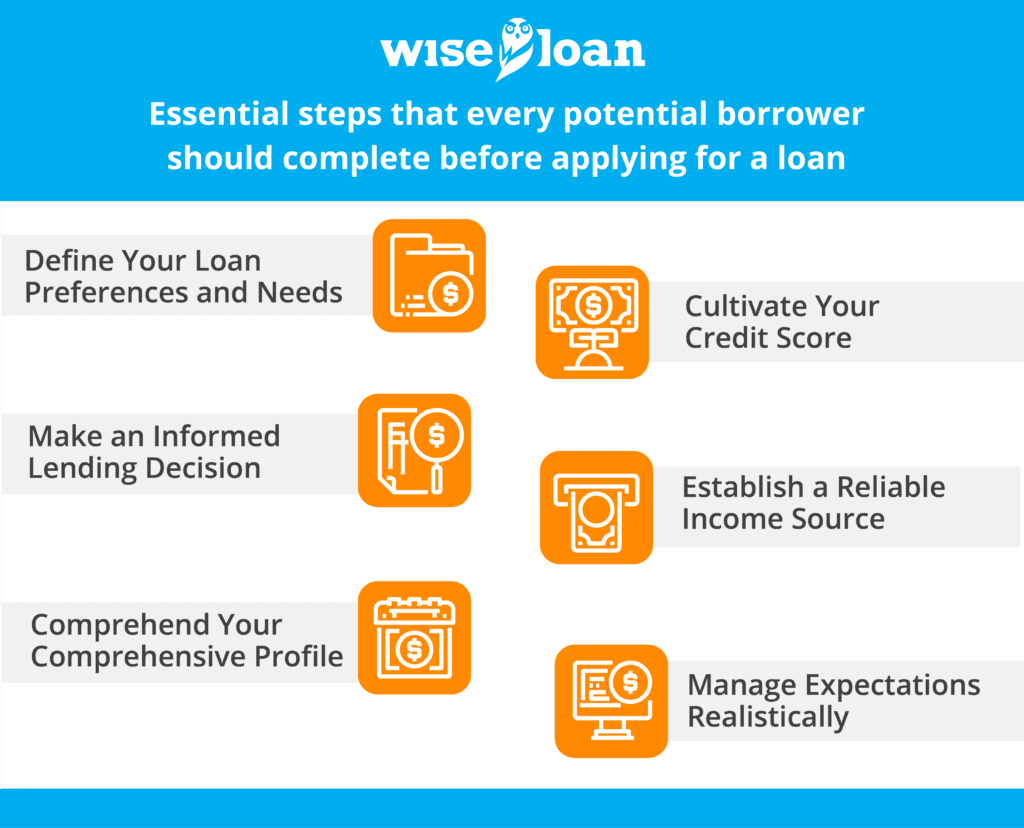

Securing loan approval in today’s lending landscape is more challenging than in the past. Presenting a comprehensive overview of your financial standing and background is crucial for lenders to conduct an impartial and thorough assessment of your financial health. To enhance your likelihood of obtaining a loan with favorable terms, there are several essential steps that every potential borrower should complete before applying for a loan.

Define Your Loan Preferences and Needs

The realm of loans encompasses diverse categories catering to various borrower profiles. From mortgages and auto loans to credit cards and personal loans, it’s vital to discern the most suitable loan type when embarking on your search. Furthermore, there are secured loans that particularly benefit individuals with imperfect credit histories. By offering your home or vehicle as collateral, you become eligible for improved rates on mortgages, car loans, or home equity loans. Clarifying your willingness to stake an asset on the loan before applying demonstrates your commitment to responsible borrowing, reassuring lenders of your intent to repay promptly.

Make an Informed Lending Decision

Engaging in thorough research is prudent, especially for financial services such as loans. Depending on the loan type you require, initiate your quest by exploring local institutions known for delivering cost-effective loans that align with your needs. Assess multiple lenders, meticulously comparing their charges and interest rates. It’s essential to establish a well-defined budget that accommodates terms within your feasible range before engaging with lenders. Additionally, having a grasp of your “over-budget” threshold, encompassing interest rates and monthly payments that you can manage in challenging situations, is advisable.

Cultivate Your Credit Score

At the very least, you should be familiar with your credit history and current credit score before approaching any lender. This can be conveniently achieved by accessing your FICO score or obtaining a comprehensive credit report from major consumer credit reporting agencies like Experian, Equifax, or TransUnion. If there are blemishes in your credit history and you can afford to postpone your loan application, consider rectifying your credit beforehand. Settle outstanding debts if feasible. A higher credit score coupled with a cleaner credit history paints a more favorable portrait for potential creditors.

Establish a Reliable Income Source

While a solid credit rating and score hold significance, a stable and current income carries equal weight. Yet, merely having an existing income might not suffice—demonstrating a consistent income history is equally essential. Presenting evidence of responsible citizenship and contribution bolsters your chances of securing a sizable loan on advantageous terms. For self-employed individuals, showcasing several years of steady business income is crucial.

Comprehend Your Comprehensive Profile

Vigilance regarding your “debt-to-income ratio” is imperative. This metric is derived from dividing your gross monthly income by your aggregate monthly debt payments. Lenders employ this ratio to assess your repayment capacity for both current and prospective loans. When seeking a loan, request the minimum amount necessary. The sum you owe constitutes 30% of your FICO credit score. Minimizing your debt relative to your potential borrowing capacity enhances your credit score and can lead to lower loan interest rates.

Manage Expectations Realistically

Lending institutions adhere to a specific approval process. While certain loans might receive instant “preapproval,” the precise terms and conditions may take days or even weeks to materialize after the initial loan application is processed. Maintain awareness of the procedural sequence during this period. In case your loan application faces denial, inquire about specific reasons from your lender. Exercise caution when contemplating applications to alternative lenders. Numerous applications submitted concurrently can negatively impact your credit rating and potentially hinder future loan approval prospects.

The recommendations contained in this article are designed for informational purposes only. Essential Lending DBA Wise Loan does not guarantee the accuracy of the information provided in this article; is not responsible for any errors, omissions, or misrepresentations; and is not responsible for the consequences of any decisions or actions taken as a result of the information provided above.