Struggling to Keep Up with Rent Payments? Manage Your Finances with Loans for Rent.

Get a loan for rent quickly with our online installment loans.

Join our hundreds of borrowers who have alleviated the burden of high rent.

Hear From Our Customers

Reviews

Customers say: The reviews reflect an overwhelmingly positive sentiment toward the company and its customer service representatives. Customers consistently express appreciation for the helpful, patient, and knowledgeable assistance they received. The overall tone is decidedly positive, with recurring themes of representatives going "above and beyond" to address customer needs and alleviate stress. Many reviewers highlight the respectful and understanding nature of their interactions, with several indicating strong loyalty to the company as a result of their positive experiences. The professional yet friendly demeanor of staff appears to be highly valued by customers, with multiple mentions of representatives easing customers' concerns. The reviews collectively suggest a company that has established a reputation for excellent customer service, with several customers explicitly stating their intention to remain long-term clients or recommending the service to others.

A++ Service

Angie -

Baton Rouge, LA 70820

Kind, professional and knew exactly what to do! Great representative I really appreciate it talking to him!

Excellent service

Scott -

Galena Park, TX 77547

Sheena is very courteous and knowledgeable. Helping me thru a bad situation, she was very helpful and gave me all my options and answered all my questions and got it all worked out.

Response from Wise Loan:

Scott, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent service

Oliver -

Lehi, UT

He was very kind and able to help me with my account.

Response from Wise Loan:

Oliver, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Good service

Allen -

Highlands, TX 77562

Response from Wise Loan:

Allen, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent Service

Cesar -

Houston, TX 77084

Thank you for your attention and service.

Response from Wise Loan:

Cesar, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent service

Wanda -

New Orleans, LA 70128

I wanna thank the young that helped me today.Who was very kind ,patients ,helpful to all of my needs I would like to let her supervisor and higher authority. know as being a loyal customer with wise lawn for a long time, this is the type of person that I would LOVE talk to again i do not know the young lady's name, but I would like to say HATS OFF to her bring PATIENCE and KNOWLEDGEABLE of my needs , this is what you call PERFECT CUSTOMER SERVICE. I would Rate her 1 - 10 more she will always be a ( 20 )to me . LONG TIME CUSTOMER, NOW A CUSTOMER FOR LIFE Wanda Nichols

Response from Wise Loan:

Wanda, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent service

Charles -

Boise, ID 83704

Highly recommend

Response from Wise Loan:

Charles, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent Service, very helpful

Rita -

San Antonio, TX 78251

Very helpful and was able to ease my stress load.

Response from Wise Loan:

Rita, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent job 👍

Johnny -

Dallas, TX 75233

The representative, Sheena, provided me with helpful, polite, and friendly professional service. She was very patient with me while I installed my account payment details.

Response from Wise Loan:

Johnny, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent work

Christina -

McAllen, TX 78501

My representative treated me with respect and understood my situation and help me out. I am happy for the way that he was able to help me out. Excellent work.

Response from Wise Loan:

Christina, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent/Helpful Service

TD -

Dixie, LA 71107

Robby was a very pleasant helpful person which whom to speak. He was very understanding and went above and beyond to make sure I didn't put myself in a further bind. I'm very grateful to him.

Response from Wise Loan:

Tanny, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent Service

Lonnie -

Mesquite, TX 75149

This is a great company. I’ve had them for a while.

Response from Wise Loan:

Lonnie, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent customer service

Manuel -

Dallas, TX 75240

Response from Wise Loan:

Manuel, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at hello@wiseloan.com. Best regards, Wise Loan

Excellent service

RR -

Corpus Christi, TX 78414

Response from Wise Loan:

Rajanikanth, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at email hello@wiseloan.com. Best regards, Wise Loan

EXCELLENT SERVICE

Marty -

Galvez, LA 70769

Response from Wise Loan:

Marty, thank you for taking the time to provide your experience. We value your insights and strive to go the extra mile to assist you. If we can be of further assistance, please do not hesitate to contact us directly at email hello@wiseloan.com. Best regards, Wise Loan

Emily C.

Rey T.

Rey T.

Rey T.

Rey T.

ROBBY G.

Rey T.

Rey T.

Emily C.

Sheena U.

Sheena U.

Sheena U.

ROBBY G.

Rey T.

Rey T.

Rey T.

Rey T.

Sheena U.

Sheena U.

Emily C.

Rey T.

Rey T.

ROBBY G.

Rey T.

Rey T.

What Are Loans for Rent?

Loans for rent are emergency loans specifically designed to help individuals cover their rent expenses. These loans offer a quick and convenient solution for those struggling to keep up with high electricity, water, or gas bills. By receiving funds quickly, they ensure you can avoid service disruptions and maintain a comfortable living environment.

How It Works

Applying for a loan for rent with Wise Loan is a straightforward, three-step process:

1

Apply for a Rent Loan

Rent payments can’t wait. Our application is simple and takes less than 5 minutes. You must have a checking account to apply.

Receive a Loan Decision

After completing the application, you’ll receive a loan decision within minutes, reducing the stress of sudden rent increases.

3

Get Funds

Once you accept the loan agreement and get approved, you may be eligible to receive funds within 15 minutes.* We also offer same-day and next-day funding.

*In addition to meeting our normal loan qualifications, you must provide a debit card associated with your checking account, apply and be approved with the loan document signed by 5:30 pm CT.

Why Choose Wise Loan?

When seeking a loan for rent, it’s vital to partner with a trusted and reputable lender. Wise Loan is a reliable option known for its

customer-centric approach and commitment to helping individuals facing financial challenges. With flexible repayment terms and quick approval processes, Wise Loan can provide the relief you need without unnecessary stress.

How Can I Use Rent Loans?

Rent loans can be used for various utilities you may be unable to financially cover, including, but not limited to:

Water

Gas

Electric

Internet

Whatever costs you encounter, loans for rent from Wise Loan can help you manage and pay for them efficiently.

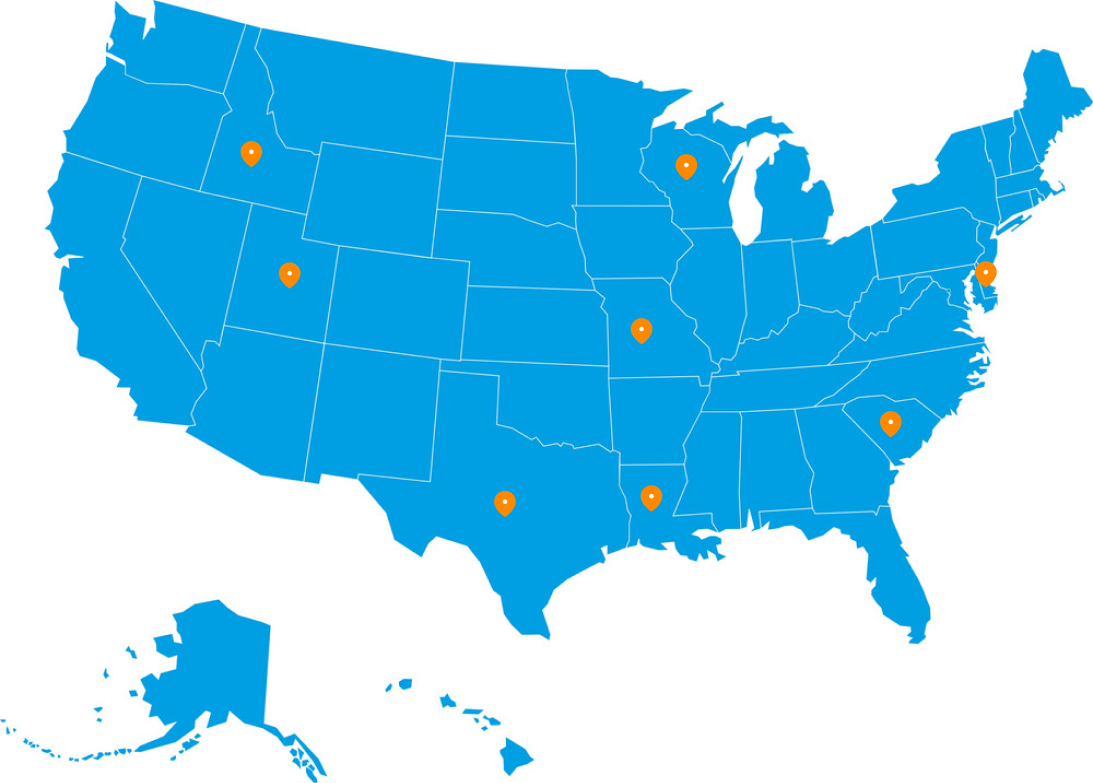

We Proudly Serve These Locations

Frequently Asked Questions About Loans for Rent

How Do I Get a Loan for Rent?

To get a loan for rent, research reputable lenders and gather the necessary documents. Complete the application form accurately and submit it for review. If approved, the funds will be disbursed to you.

What are the Requirements to Apply for a Loan?

At Wise Loan, we strive to make the process of applying for a personal loan as seamless and inclusive as possible. Here’s what you’ll need to get started:

- Age Requirement: Applicants must be 21 or older.

- Social Security Number: Required for identity verification.

- Banking Information: A traditional checking account is necessary. Prepaid or savings accounts are not accepted. If you opt for instant funding via debit card, ensure the card is linked to the checking account you provide in your application.

- Income Deposits: Your income must be directly deposited into the checking account used for the application.

- Physical Address: A physical residential address is required; P.O. Box addresses are acceptable only as mailing addresses.

- Monthly Income: A minimum monthly income of $1,500 is required. For residents of South Carolina and self-employed applicants, the minimum is $3,000.

How Much Can I Borrow?

The loan amount you can borrow depends on several factors, including your income, credit score, and the specific lender’s policies. Wise Loan offers loans between $200 to $1,500 ($3,500 for returning customers). Note that returning customers can access their available credit limit by logging into the customer portal or inquire about their available options by reaching out to our customer service team.

What is the Easiest Loan to Get For Rent?

The most accessible loan to get for rent varies depending on your unique circumstances. However, payday loans are often perceived as more accessible due to less stringent credit checks and quick approval processes.

What Happens If I Miss a Loan Payment?

In the event of missing a loan payment, it’s crucial to note that interest continues to accrue, potentially impacting the overall cost of the loan. Therefore, it’s essential to proactively communicate with Wise Loan to explore available options and potential solutions to mitigate any negative consequences and ensure a smooth repayment process.

Other Emergency Loan Options

Medical Loans

Tackle medical expenses head-on. With our medical loans, prioritize your health without compromise.

Auto Repair Loans

Navigate vehicle breakdowns without a hitch. Get back on the road quickly with our auto repair loans.

Home Repair Loans

We have your back for unforeseen home damages. Our home repair loans are here to help.

Resources

Is It Wise to Take a Loan From Your 401(k)? What You Need to Know Before Borrowing

Your 401(k) balance looks reassuring when money gets tight. It's your money, after all. But before you borrow from your retirement account, you need to understand...

Why Wise Loan Costs More And Why Customers Choose Us Anyway

At Wise Loan, we read every review, comment, and piece of feedback. Transparency is not a marketing tactic for us. It is a responsibility. Yes, Wise Loan is a...

Practical Financial Tips to Stay in Control of Your Money Year-Round

Managing money isn’t about being perfect—it’s about making consistent, realistic choices that fit your life. Most people don’t struggle because they’re...